Global fintech provider Ant International supported more than 2 billion digital cross-border transactions in 2025, as it expanded AI-powered payment, banking, and digital commerce tools across its core emerging markets in Southeast Asia, South Asia, the Middle East, and Latin America.

The company currently serves over 150 million merchants globally, with 90 percent classified as small and medium enterprises (SMEs). Ant International said these merchants recorded strong gains from increased access to digital payments, cross-border connectivity, and banking solutions in fast-growing but fragmented digital economies.

Digital Inclusion Multiplies Growth

Payment digitalization and integration remain crucial for business success across emerging markets.

Through Alipay+, Ant International enables online and offline merchants to accept a wide range of QR, mobile, and card-based payments. Alipay+ now connects more than 1.8 billion user accounts across 40 international payment partners to merchants in over 100 markets.

With strong leadership across Asia, Ant International said it will continue expanding this payment connectivity into the Middle East and Latin America. Alipay+ also supports the development of local e-wallets and super apps, strengthening domestic fintech ecosystems while enabling cross-border interoperability.

Access to Banking and Financing Remains a Priority for SMEs

Despite progress in digital payments, access to banking and financing remains a key challenge for SMEs across emerging markets.

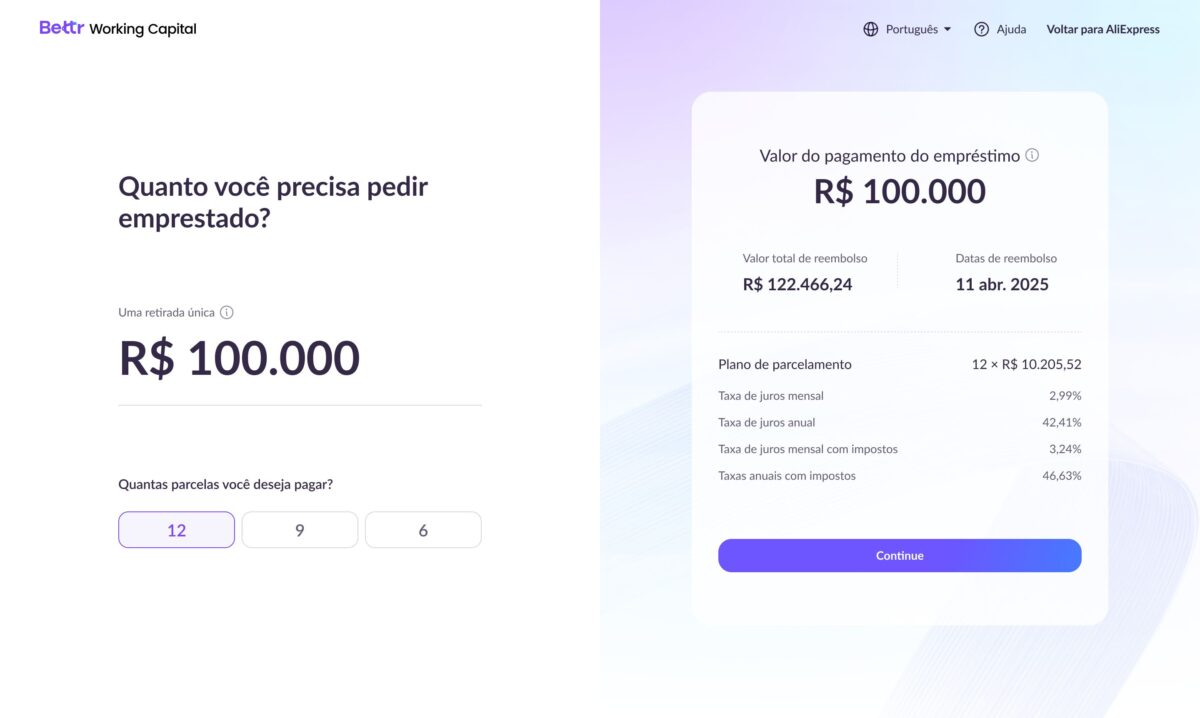

Ant International’s credit technology platform Bettr expanded services to support over 30 million SMEs and individuals, while extending its footprint into Latin America following a strategic investment in embedded lending infrastructure provider R2. Bettr enables digital platforms to provide SMEs with easier access to financing through data-driven credit assessment.

Meanwhile, WorldFirst has evolved into a global digital account service offering payment and financial management tools across more than 200 markets and 130 e-marketplaces, supporting SMEs engaged in cross-border trade and e-commerce.

Putting Trusted AI Innovation on the Ground

Ant International continues to position artificial intelligence as a practical enabler of commerce rather than a standalone technology.

In 2025, the company open-sourced its Falcon Time-Series Transformer AI model, improving foreign exchange risk management and reducing hedging costs by up to 40 percent for enterprise clients. On the merchant side, Antom, Ant International’s flagship payment services platform, cut payment integration time by as much as 95 percent through AI-powered tools.

Antom clients recorded 75 percent growth outside China, reflecting rising demand from merchants operating across Asia, Europe, and other international markets. Regional platforms such as 2C2P in Southeast Asia and MultiSafePay in Europe continue to support businesses ranging from airlines and e-commerce players to local SMEs.

Security remains foundational. Ant International’s SHIELD AI risk management model achieved 95 percent precision in identifying high-risk transactions while improving payment success rates.

Interoperability and Real-Time Payments Shape the Future of Commerce

Cross-border interoperability across diverse payment methods continues to drive trade, tourism, and economic growth.

Alipay+ currently collaborates with 11 national QR payment networks globally, enabling consumers to use their home wallets abroad while helping merchants benefit from international spending. Through partnerships with Mastercard, Alipay+ partners can also support NFC-based wallet-to-card payments across card-enabled terminals.

Ant International’s platform technology processes over USD600 billion in cross-border fund transfers using blockchain infrastructure, with more than 95 percent completed on the same day. The company has also pioneered bank-to-wallet payments in partnership with SWIFT, allowing bank customers to send funds directly to mobile wallets.

Southeast Asia Remains a Key Fintech Growth Market

After more than a decade of working with local partners, Ant International said Southeast Asia continues to deliver strong momentum, driven by mobile wallet adoption, tourism recovery, and cross-border e-commerce growth.

Across the region, super apps are increasingly deploying AI-driven services to enhance payments, travel, and commerce experiences. Interoperability initiatives have also generated measurable economic value for SMEs by increasing transaction volumes and customer reach.

“As digital economies across Southeast Asia and other developing markets continue to scale, Ant International remains focused on enabling access and fostering shared prosperity,” the company said.