Research by the Robocash Group reveals that improvements in the employment rate and the final household consumption volume of the Filipino population will positively affect alternative lending in 2022.

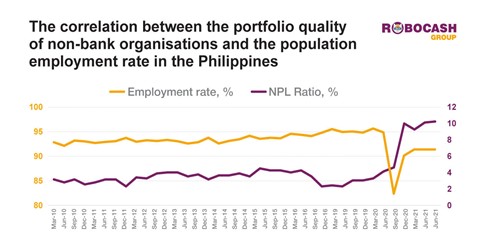

The portfolio quality of alternative lenders has considerably decreased due to the Covid pandemic. While before, the rate of the late repayments (i.e. non-performing loans NPL) used to comprise 4-5%, and this number has been at 10-10.5% since Q3 2020. The worsening of the portfolio quality signifies the borrowers’ inability to repay loans.

The population employment rate is one of the indicators of a borrower’s creditworthiness. The wage may grow and diminish, yet it still exists and covers one’s needs. Employment or lack thereof, on the other hand, affects one’s well-being in a more significant fashion.

In 2020, the employment rate suffered a sharp decrease, while the NPL share grew, i.e. the portfolio quality worsened. Thus, with a decrease in employment rate comes a rise in non-performing loans, and vice-versa.

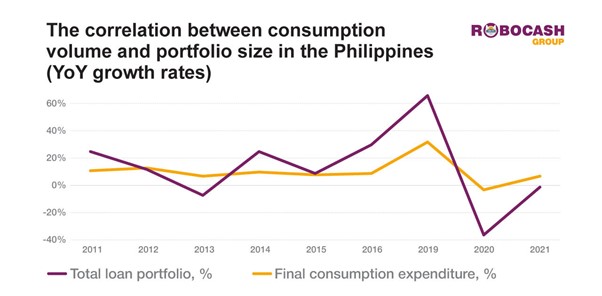

According to the analysis of Robocash Group, in 2022 in the Philippines, with an increase in employment by at least 1%, the share of non-performing loans will decrease by 0.33%. It’s also noted that the increase in the volume of final consumption of households has a strong positive impact on the portfolio volumes of non-banking organizations.

The Philippines economy is on its way to recovery. According to the quarterly survey of consumer expectations by the Central Bank of the Philippines, Filipinos expect the employment rate to grow. The population’s wellbeing and the general state of the economy in the country are expected to improve.

Analysts at Robocash Group comment: “In 2022, Philippine alternative lending will experience growth both in quality of the portfolio and in size. This assessment can be made based on the existing positive effect the employment rate growth has had on the portfolio quality, as well as a positive impact on the market volume due to the increase in consumption volume. The same notion is echoed in third-party forecasts.”