With digital payments becoming the go-to choice for seamless transactions, Google is excited to announce that Google Wallet is now available in the Philippines. Google Wallet provides people with a safer, simpler, and more helpful payment experience and supports digital items such as loyalty cards and boarding passes. To get started, download Google Wallet from the Google Play Store.

“The Philippines is a nation on the move—vibrant, mobile-first, and rapidly embracing digital life. Google Wallet is launching right alongside that energy, offering Pinoys a single, secure digital space to manage their payments, travels, and daily transactions. Whether it’s the quick ‘tap-and-pay’ for your favorite restaurant, booking a trip across the islands, or shopping online, Google Wallet keeps your essentials protected and always at your fingertips. This launch underscores our enduring commitment to accelerating financial inclusion and fueling the next chapter of the Philippines’ dynamic digital economy,” said Prep Palacios, country manager, Google Philippines.

“Google Wallet’s arrival reinforces our collective vision for a fully digital and financially inclusive Philippines,” said Lito Villanueva, founding chairman of FinTech Alliance PH and RCBC executive vice president & chief innovation and inclusion officer. “This collaboration with Google Wallet alongside the BSP and the DICT demonstrates how strong public-private partnerships can expand access, enhance trust, and deliver world-class digital payment experiences for every Filipino from urban centers to the countryside.”

BSP Deputy Governor Mamerto E. Tangonan emphasized, “The BSP promotes financial stability and maintains a forward-looking stance on payment innovation. We recognize the role of TSPs in advancing payments digitalization, consistent with the development goals under the Philippine Development Plan (PDP) 2023-2028. While we do not consider technology service providers as operators of payment systems, we underscore that BSP-supervised institutions (such as banks and e-money issuers) engaging these providers remain fully responsible for managing associated risks.”

DICT Secretary Henry R. Aguda added, “The launch of Google Wallet aligns perfectly with our digitalization agenda. Secure and interoperable digital payment solutions like this bring government, commerce, and citizens closer together, ensuring no Filipino is left behind in the digital economy.”

Cardholders of participating banks can add their cards to Google Wallet and pay with their Android phones or Wear OS devices wherever contactless payments are accepted. Payment cards from Google Wallet can be used to pay online or in-app at merchants such as Shopee, wherever you see the Google Pay button.

Google Wallet acts as a digital container on Android, safely holding all the credentials typically kept in a physical wallet, like payment cards, loyalty passes, and more. When a consumer taps to pay in a store or make a purchase online, the actual payment is enabled by Google Pay. Essentially, the payment cards sit in the Google Wallet, and the transaction is carried out by Google Pay.

Online merchants supported by payment service provider partners will be able to offer a faster, more secure, and seamless payment experience with Google Pay.

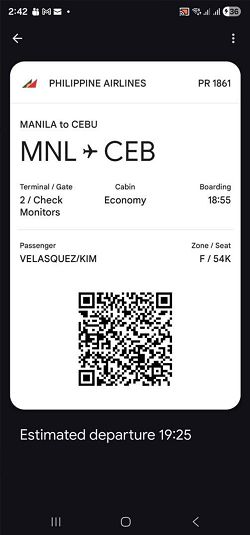

In addition to storing and accessing payment cards, travelers can add boarding passes from Philippine Airlines and others to Google Wallet. With boarding passes in Google Wallet, travelers will be notified of changes to departure time and gate changes to ensure a hassle-free experience at the airport. Furthermore, they will be able to tap and pay securely using Google Wallet during their overseas travel, without the need for their physical card, wherever contactless payments are accepted

Furthermore, event tickets, cinema tickets, loyalty cards, digital vouchers, and digital car keys can also be added.

Using Google Wallet is Simple

Simply follow the on-screen steps to set it up for contactless payments. If you don’t have a card saved and would like to add a new one, tap “Add a card” in the carousel at the top of the page, review and accept the issuer’s terms and conditions, and complete the verification process. Your card will then be ready for use in Google Wallet.

Adding digital items such as boarding passes to Google Wallet is equally simple. For example, after purchasing a flight ticket, consumers will see a button labeled “Add to Google Wallet,” which creates a digital version of the booking for easy access in their Google Wallet.

Travellers can start to add digital items such as boarding passes, bus, train, and event tickets into their Google Wallet

If you’re someone who has a lot of membership or loyalty cards to keep track of, Google Wallet can store them all in one place. You can also add these manually using the same process as adding a payment card. Shoppers can now add their IKEA Family card membership and Mang Inasal vouchers to Google Wallet, making it easier to access rewards and benefits seamlessly from their Android devices.

Using Google Wallet is Secure

Privacy and security are the cornerstones of Google Wallet, offering industry-standard tokenization to keep transactions safe. When making a payment, Google Wallet uses an alternate card number (a token) that is device-specific and associated with a dynamic security code that changes with each transaction. Banks also require verification before adding a card to your device, and screen lock protection ensures that only you can access your Wallet.

If your phone is lost or stolen, you can use the Find My Device function to lock it instantly, secure it with a new password, or erase your personal information and payment details.

To provide transparency and control over information management, consumers can update their settings from the Google Wallet app or on their computer at myactivity.google.com/product/wallet.

Download Google Wallet from the Google Play Store and enjoy a faster, safer, and more convenient way to pay and store your digital essentials.

Partners launching with Google Wallet / Google Pay:

Google Wallet is a safer, simpler, and more helpful way to access essentials like payment cards, loyalty cards, and boarding passes from your Android devices. These partners include:

- VISA and Mastercard Cardholders of ChinaBank, East West bank, RCBC Bank, Zed will be able to add their cards to Google Wallet.

- VISA cardholders of GoTyme, Maya, UnionBank, Wise will be able to add their cards to Google Wallet.

- Mastercard cardholders of GCash and Zed will be able to add their cards to Google Wallet.

- Travelers can add many types of information to Google Wallet: including boarding passes from Philippines Airlines, and AirAsia, Cathay Pacific, Jetstar, Malaysia Airlines, Singapore Airlines, Scoot, Thai Airways; flight bookings from Trip.com; event tickets booked through Ticket2me and Ticketnet; IKEA loyalty cards and Mang Inasal vouchers.

- For transit, Google Wallet can be used to Tap and Pay at MRT-3 in Manila and on modern jeepneys in Cebu and Mandaue City as well as wherever VISA/Master cards are accepted and bus tickets purchased through Easybook. Tickets purchased through the Beep App to travel on buses and trains in Manila is coming soon,

- Checkout with Google Pay when making online purchases on Shopee, Sephora (coming soon), and with merchants supported by Payment Service Providers such PesoPay, Payermax, and coming soon with 2c2p, Payermax, Paymongo, and Maya

Digital Car Keys – refer to https://www.android.com/digital-car-key/#digital-compatibility for details on supported car models and Android devices.