As the Philippines charts its path toward economic recovery, digital financial services leader PayMaya is providing full support to micro-, small-, and medium-sized enterprises (MSMEs) across the country to accelerate their transition to e-commerce with the help of digital and cashless technology.

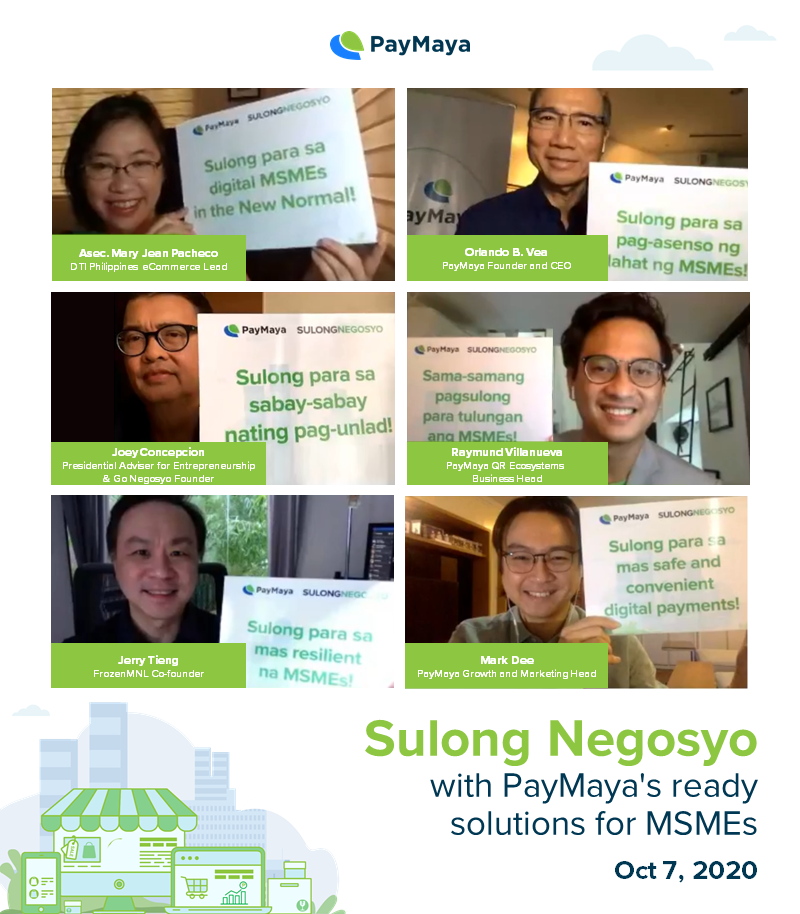

Through a campaign entitled “Sulong Negosyo” launched on October 7, PayMaya announced product, programs, and partnership support worth up to PHP 60 million to help jumpstart the recovery and growth of MSMEs in the country aided by cashless and contactless payments.

“MSMEs form a critical sector in our country’s recovery from the current crisis. With all businesses compelled to to go digital, MSMEs should not be left behind. ‘Sulong Negosyo’ is our rallying action to enable MSMEs with cashless technologies,” said Orlando B. Vea, founder and CEO of PayMaya.

Based on recent figures from the Department of Trade and Industry (DTI) and the Department of Labor and Employment (DOLE), an estimated 90,000 businesses remain closed and over 200,000 workers have permanently lost their jobs as a result of the COVID-19 pandemic, many of which belong to the MSME sector.

However, the entrepreneurial spirit is strong among Filipinos. In the recent 2020 Global Entrepreneurship Survey conducted by Go Daddy, 1 in 3 Filipinos started a micro business during the pandemic, becoming home-based entrepreneurs, offering products and services online through social media or chat apps. This new wave of literal home-grown MSMEs is harnessing the power of digital for recovery.

With cashless fast becoming the default choice for payment among consumers, providing our MSMEs with the ability to accept all types of cashless payments, whether online or in their physical stores, will hasten their cash flow and also promote public health safety.

Cashless products to digitally fuel MSMEs

“Even as the economy reopens, online, cashless, and contactless transactions are here to stay as customers choose convenience and safety. The next phase of commerce will be digitally-fueled, so equipping MSMEs with the right tools and payment options in order to succeed in this new era is one of our main priorities at PayMaya,” said Raymund Villanueva, business head for QR Ecosystems at PayMaya.

In this regard, PayMaya is providing various cashless payment tools for MSMEs such as:

- PayMaya QR codes that can easily be shared via social media or chat apps, or displayed for face-to-face transactions, allowing sellers to receive instant payments from PayMaya users.

- PayMaya Payment Links help MSMEs that do not have established e-Commerce stores by allowing them to generate links which they can send to their customers for payment. Once clicked, customers will be led to their own PayMaya payment page where they can pay using their PayMaya account or Visa, Mastercard, and JCB credit or debit cards.

- PayMaya Checkout Plugins are for MSMEs operating online stores powered by Shopify, Magento, or WooCommerce that allows for quick and easier integration of the PayMaya Checkout payment gateway without the need for advanced coding knowledge or experience.

MSMEs interested in these solutions can easily sign up and upload their requirements by using the new PayMaya Business Manager at http://pymy.co/BeAMerchant or by downloading the PayMaya Negosyo app from the Google Play Store.

Rewarding entrepreneurship

To help encourage more MSMEs to go digital and cashless, PayMaya has also launched its “PayMaya Negosyante Rewards” program, providing benefits to members such as:

- Exclusive rewards to merchants whenever they accept cashless payments through various PayMaya products and solutions

- Free advertisements and marketing tools to help promote their products and services online through PayMaya’s various digital properties and within the PayMaya app

- Free livelihood trainings and online courses with industry experts to help them gain business and digital skills to prepare them for the New Normal

Aside from this, MSMEs can also augment their income by operating as a Smart Padala/PayMaya Negosyo agent in their physical stores, where they can process remittances, accept bills payments, and sell mobile prepaid load, among others.

Those interested to join the PayMaya Negosyante Rewards program can visit pymy.co/Negosyante to sign up today.

Advocating digital entrepreneurship

During the Sulong Negosyo campaign launch, PayMaya also announced it has tied up with entrepreneurial advocacy group Go Negosyo for various income opportunities and mentorship programs in the next several months.

“MSMEs are the backbone of our economy, so a concerted effort among government, the private sector, and civil society will definitely help boost their recovery in the months ahead. We thank PayMaya for this partnership that will definitely help provide a lot of opportunities to learn and earn for many small businesses across the country,” added presidential adviser for entrepreneurship Joey Concepcion, who is also the founder of Go Negosyo.

MSMEs participating in Go Negosyo programs across the country can enjoy access to PayMaya products, with assistance on onboarding, incentives, and training resources.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cut across consumers, merchants, and government. Aside from providing payments acceptance for the largest e-Commerce, food, retail and gas merchants in the Philippines, PayMaya enables national and social services agencies as well as local government units with digital payments and disbursement services.

Through its app and wallet, PayMaya provides millions of Filipinos with the fastest way to own a financial account with over 57,000 Add Money touchpoints nationwide, more than double the total number of traditional bank branches in the Philippines combined.Its Smart Padala by PayMaya network of over 30,000 partner touchpoints nationwide serves as last mile digital financial hubs in communities, providing the unbanked and underserved with access to services. To know more about PayMaya’s products and services, visit www.PayMaya.com or follow @PayMayaOfficial on Facebook, Twitter, and Instagram.