Equipped with almost 25 years of expertise in the remittance industry, a well-established network through partnerships and over 3,500 physical locations across the country, PERA HUB is introducing its latest innovation as a solution: the Digital Remittance Platform or DRP.

Remittances and digital transactions continue to grow this year, according to data from the Bangko Sentral ng Pilipinas (BSP)—signifying an opportunity for more streamlined financial processes and service providers.

According to the central bank, remittances from overseas Filipinos reached USD3.24 billion from January to July 2022, a 2.3% increase from last year. The BSP also noted in the same period the combined value of transactions under PESONet and InstaPay at over PHP5.37 trillion, a 43% growth from 2021. While these could be attributed to the increase in the number of financial and remittance services, these also caused more problems specifically for businesses: the hassle of connecting with multiple networks and providers, as well as the inefficient and painstaking process to complete the integration.

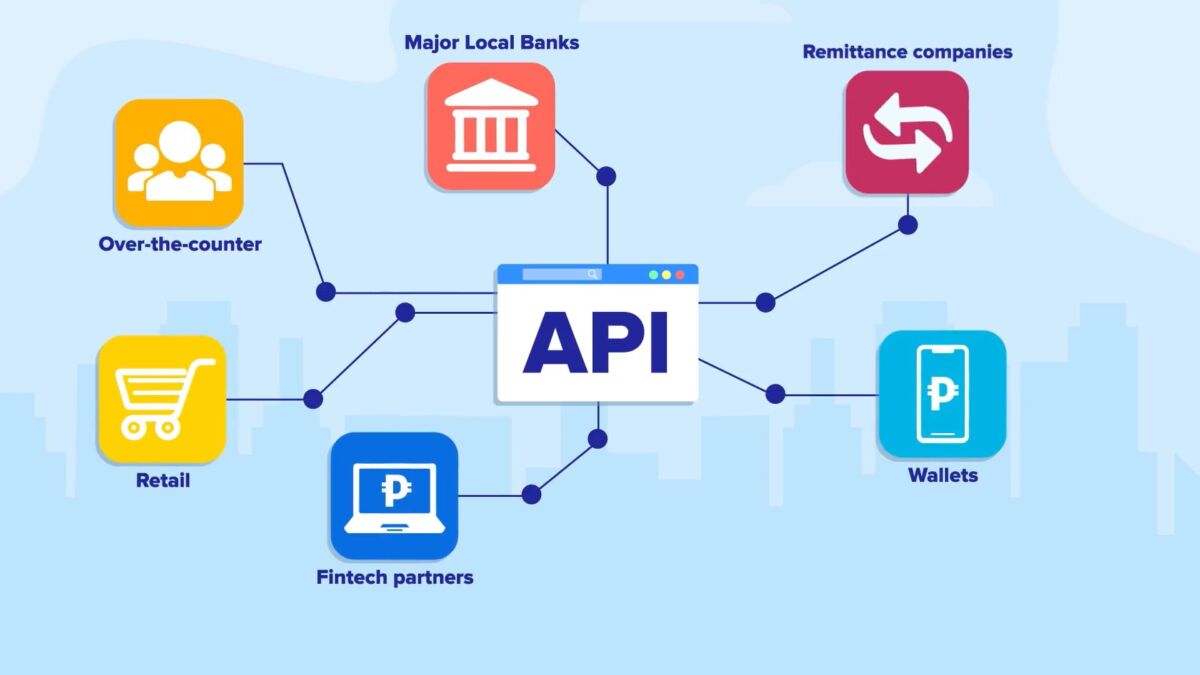

PERA HUB DRP is the first aggregated, single Application Programming Interface (API) platform in Southeast Asia that allows different businesses to integrate and connect to a network of retail and over-the-counter partners, major Philippine banks, remittance companies, digital wallets, and even emerging fintech. The platform, regulated by the BSP, is powered by a modern and secure API developer portal that enables access to PERA HUB’s network of financial services easily with an Open API standard.

“When talking about APIs and dealing with partners who are Banks, EMIs, or other financial service providers, it is crucial that we always ensure the security of transactions,” said Bryan Makasiar, PERA HUB senior assistant vice president for Digital Business. “As a company, we were able to establish that capability plus accessibility and convenience through our infrastructure and people, to get the nod from the BSP.”

The DRP is best suited for financial services companies looking to increase their distribution channels quickly through PERA HUB’s physical network and digital community partners, as well as companies with digital communities aiming to provide reliable and scalable financial services.

This innovation is the recent recipient of the Asian Business Review’s Asian Technology Excellence Awards. For its “technological revolution and digital transformation”, PERA HUB DRP was given the Philippines Technology Excellence Award for Fintech–Remittance.

Ian Ocampo, president and CEO of PERA HUB, described the award as a “stepping stone” towards further innovation and explained the rationale behind the company’s establishment of the DRP.

“PERA HUB started in 1998 as a traditional brick and mortar remittance company and grew our network through partnerships with physical locations to expand our branch network. However, we recognized that we need to give our customers options on how they receive their money from their loved ones overseas and receiving it digitally is key to remain relevant in this business,” Ocampo said.

“PERA HUB saw the opportunity to leverage on our well-established partnerships to create a new platform that would enable businesses to connect to a network of remittance and other financial partners in one go. It opens an opportunity for them to easily integrate and expand their network to new customers by only connecting to one platform,” he added.

After over two decades, PERA HUB continues to improve its services for Filipinos, delivering exceptional convenience and choice while making money matters convenient. Aside from Western Union, PERA HUB DRP has also been fully integrated into other remittance providers such as Remitly, Uniteller, Japan Remit, Instant Cash, and Sendah Remit. It will be utilized as well in digital banking apps and fintech solutions like UnionBank, DiskarTech, and AllEasy.

For more details, visit perahubdrp.com and like Pera Hub on Facebook for updates.