If Japan is on your travel bucket list for 2024 or you’re planning to go anywhere abroad this year, GCash makes traveling much easier with GCash Global Pay, proving you can officially go cashless and travel without the usual worries and hassles.

Take a cue from Megan Young & Mikael Daez and their recent adventure in Japan, where they traveled cashless through their favorite places in Tokyo. They share some of their tips, discoveries, and advice on using GCash abroad and why it’s the most important and best companion for any newbie or seasoned traveler:

Scan to pay with GCash for fast, easy transactions

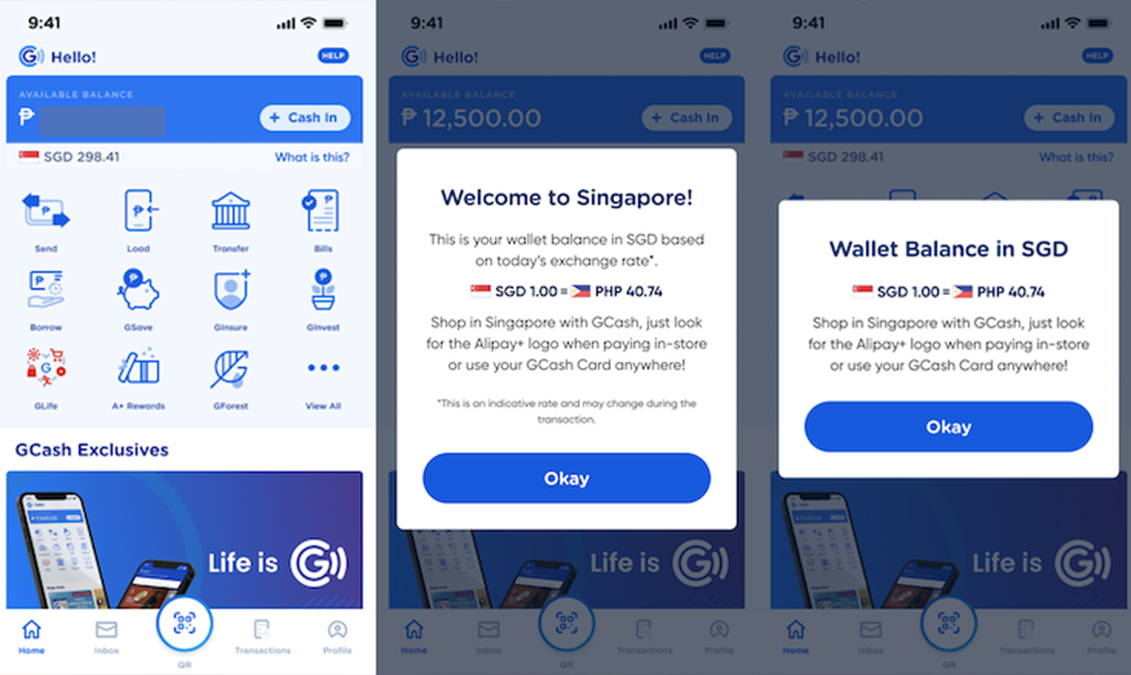

Through GCash Global Pay, in partnership with Alipay+, you can now pay in stores with your GCash wallet by scanning a QR code for hassle-free, contactless payments.

“One of the most common inconveniences when traveling to a foreign country is familiarizing yourself with the currency, and this is usually what leads to delays or misunderstandings and even the risk of overpaying. When you pay with GCash, you ensure that you always pay the right amount. Also, GCash is securely linked to your wallet, so you don’t have to deal with cash and the different currencies, which is a great help especially for first-time travelers to Japan or any other country,” explains Mikael.

When you enter any retail store, shopping mall, or convenience store, just look for the Alipay+ sign at the checkout to check if GCash is accepted as a payment method. Then pay with your GCash app by scanning the QR code or generating your own code for the merchant to scan.

“We’ve gotten used to scanning to pay locally, but it’s really nice to now be able to pay with GCash when we visited some of our favorite places like Glico and BIC Camera, or when we checked out the new Gigo flagship,” adds Megan. Aside from more accessibility and convenience in making payments, using GCash abroad opportunities to enjoy special promos and discounts.

No data? Use the newest GCash Card – accepted worldwide

In case your phone dies or in areas where you can’t get a data connection, or in merchant stores where only cards are accepted, you can pay with the newest GCash Card. The GCash Card, which is also linked to your GCash wallet, lets you make secure payments with a simple tap. Unlike credit cards, which often come with additional fees, the GCash card guarantees a fast, seamless transaction with no surprise charges.

“I’d been hearing about the new GCash Card and was so excited when I received mine to try out in Japan. One of the reasons I think the card is such a big help for travelers is that it covers all the possibilities and shows that we can all use GCash abroad. You can scan to pay and if that’s not possible, there’s still the option to pay with the GCash Card,” shares Megan.

“It was really easy checking out with the GCash Card in the convenience stores we would visit and when we would dine in restaurants,” adds Mikael.

Using GCash abroad also lets you avoid high fees at international forex

Upon arriving in a foreign country, many travelers immediately go to exchange money to the local currency. But oftentimes this comes with service fees that don’t allow you to maximize your budget. With GCash Global Pay, you don’t need to face the long lines at the airport or money changes in the city.

GCash has also launched a new feature of real-time conversion, so you can see your GCash balance in the currency of the country you are in.

GCash has extended the accessibility of GCash Global Pay via Scan QR not just in Japan but also in South Korea, Singapore, Malaysia, Hong Kong, and Macau in Asia as well as Qatar, the UAE, the USA, and destinations in Europe such as France, Italy, Germany, Switzerland, and the United Kingdom.

Say goodbye to stressful travels in 2024 and experience the ease of secure, contactless payments in just a few taps on your phone with GCash Global Pay. To learn more about this incredible travel companion, visit new.gcash.com/services/pay-qr/global-pay.