As the National Capital Region remains to be under quarantine for the next two weeks, the demand for comprehensive digital capabilities continues to accelerate.

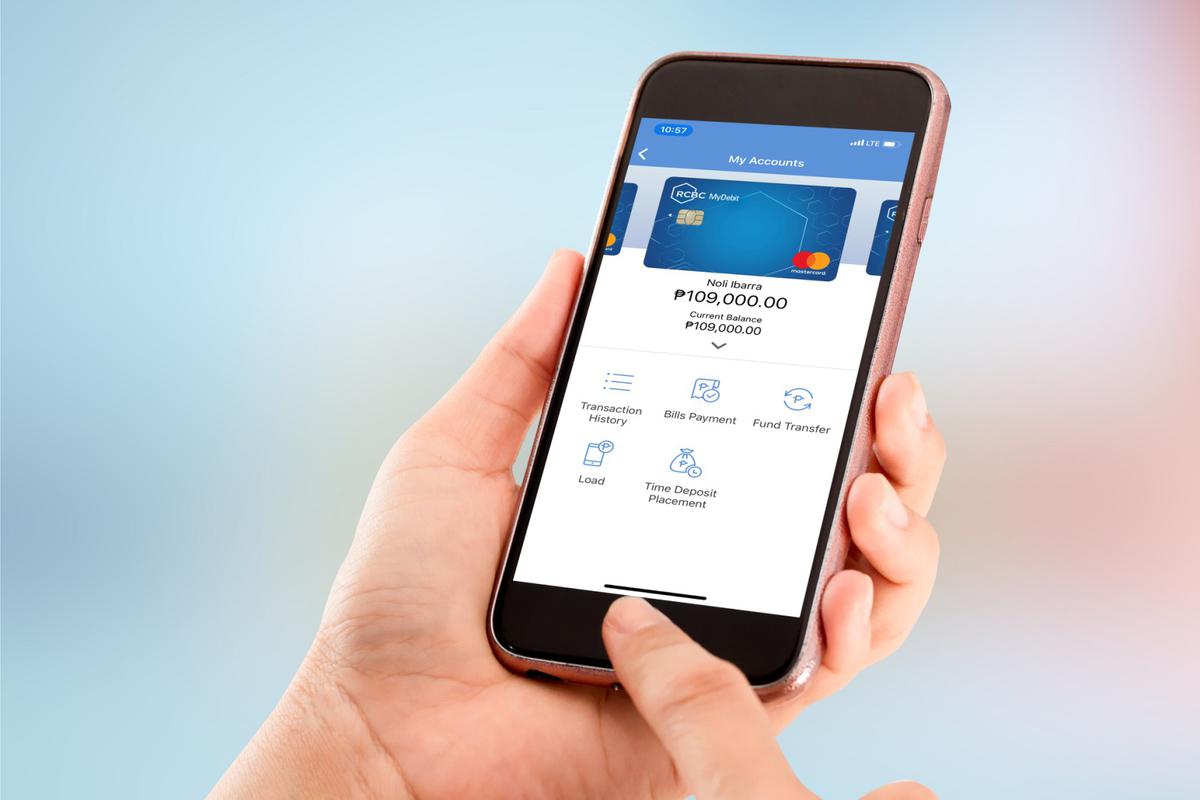

Rizal Commercial Banking Corporation’s (RCBC) mobile banking app has enabled more banking services to help clients manage their finances amidst the COVID-19 pandemic.

Among these innovative solutions are the Send Cash service, a facility that can be used to remit money to unbanked recipients in case of emergency; cardless withdrawals, so clients who have misplaced their ATM cards don’t need to worry about getting cash at any RCBC ATM; e-wallet reloading for GCash and PayMaya; and a split bill feature, which allows customers to request payment transfers from other RCBC clients.

These features are also available on the web version of RCBC Online Banking which is now integrated in the mobile app for wider availability.

“The RCBC Mobile Banking App is one of the most comprehensive online banking apps in the industry which makes us a reliable partner especially during this time,” said Lito Villanueva, RCBC executive vice president and chief innovation and inclusion officer.

Revitalized just last January, the RCBC mobile app’s interoperability and enhanced user experience make it more suitable for heavy digital banking transactions. The updates that have proven essential these days are the interbank fund transfers through PESONet and InstaPay, online check deposits for RCBC-issued checks which eliminates branch visits, and QR code capability which enables secure and faster payments.

Since the lockdown, RCBC has seen a surge in digital transactions of up to 821%. Digital banking enrollment grew by 167%, an evidence that customers are slowly migrating to digital channels.

“All these features have become important and essential in empowering RCBC clients to do their banking transactions in the new norm,” Villanueva added.

The RCBC Online Banking app update can be downloaded from the App Store, Google Play and the Huawei AppGallery. Clients who are not yet registered for online banking can simply enroll their accounts via the mobile app.