The Bank of the Philippine Islands (BPI) is encouraging Filipinos to maximize the bank’s Mobile Check Deposit feature on the BPI app, which allows clients to deposit checks in five minutes.

“As part of BPI’s customer obsession culture, we have developed the Mobile Check Deposit feature on the BPI app, allowing customers to conveniently transact anytime, anywhere. While the channel to transact is new, the same rules on clearing remain the same. Thus, customers need not worry about any delays in crediting the deposits to their accounts,” said Fitzgerald Chee, Head of Consumer Platforms.

The Mobile Check Deposit feature is currently accessible to BPI Preferred, BPI Gold, and BPI Private Wealth clients without any fees. Local checks below PHP500,000 can be deposited via the app and clients can monitor deposit status as an added feature.

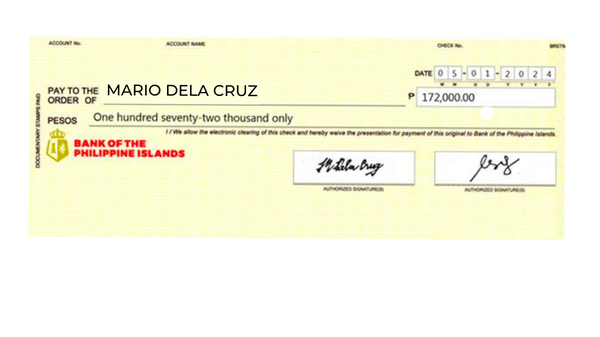

The following details must be written on the back of the check before depositing it through the BPI app:

- “Bank of the Philippine Islands” or “BPI”

- Date of the check deposit (MM/DD/YYYY)

- BPI account number

- Client’s signature

A physical copy of the check must also be kept for 12 months in case of dispute.

Clients may also deposit at any time. Checks deposited after 3PM (PHT) or on weekends and holidays will be processed the next banking day.

With this feature of the BPI app, BPI continues to digitalize transactions as part of its Phygital strategy. “As everyday transactions are migrated onto its digital platforms, branches can now take on a more advisory role — helping our clients do more and maximize opportunities to grow their funds,” Chee added.

To learn more about BPI app’s mobile check deposit, visit https://www.bpi.com.ph/personal/bank/digital-banking/mobile/check-deposit