In today’s fast-paced world, managing your finances can feel like a never-ending juggling act. Between saving, investing, paying bills, and tracking expenses, it’s easy to find yourself bouncing between multiple apps just to keep everything in check. But what if you could simplify all of this with just one app? Enter Maya, the no. 1 Digital Banking app in the Philippines —the ultimate financial tool that brings everything you need under one roof.

One App for Total Financial Control

Why waste time and energy switching between different apps when Maya can do it all? Whether you’re saving for a goal, growing your investments, or managing daily expenses, this superapp puts every financial tool you need in one place. No more juggling passwords or losing track of your money—just seamless financial management that saves you time and stress.

Earn While You Spend

Imagine boosting your cash flow just by going about your daily routine. With Maya, you can earn up to 15% annual interest on your savings, simply by using the app for your everyday transactions. And if you’re a TNT subscriber, the app’s new ‘TNT Alkansya’ promo offers 1% cashback plus an extra 1% interest on your savings when you purchase at least PHP100 TNT load. Simplifying your finances never felt so rewarding.

Crush Your Financial Goals, Stress-Free

Have a big goal in mind? Maya’s Personal Goals feature helps you stay on track with a 4% annual interest boost while you work towards your dream vacation, a new gadget, or an emergency fund.

For those extra funds you want to park safely, Time Deposit Plus is your spot. Enjoy up to 5.75% annual interest, credited monthly. Manage up to five accounts, each with a maximum of ₱1 million, and lock in your funds for up to 12 months.

Invest Like a Pro, Without the Hassle

Ready to dive into investments? Maya Funds makes it a breeze. With this platform facilitating access to investment opportunities, you can manage 13 professionally curated local and global funds featuring major players like Apple, Microsoft, and PLDT. These funds are managed in collaboration with Seedbox Philippines, ATRAM Trust Corporation, and BIMI, giving you a diversified portfolio to manage risks effectively.

Prefer trading directly? Maya Stocks connects you with top brokers—Philstocks, 2TradeAsia, and DragonFi—so you can trade over 280 companies listed on the Philippine Stock Exchange, like SM and Aboitiz. Just cash in to your broker account and start trading instantly through the superapp. With real-time insights and powerful tools, you’ve got everything you need to make smart moves effortlessly.

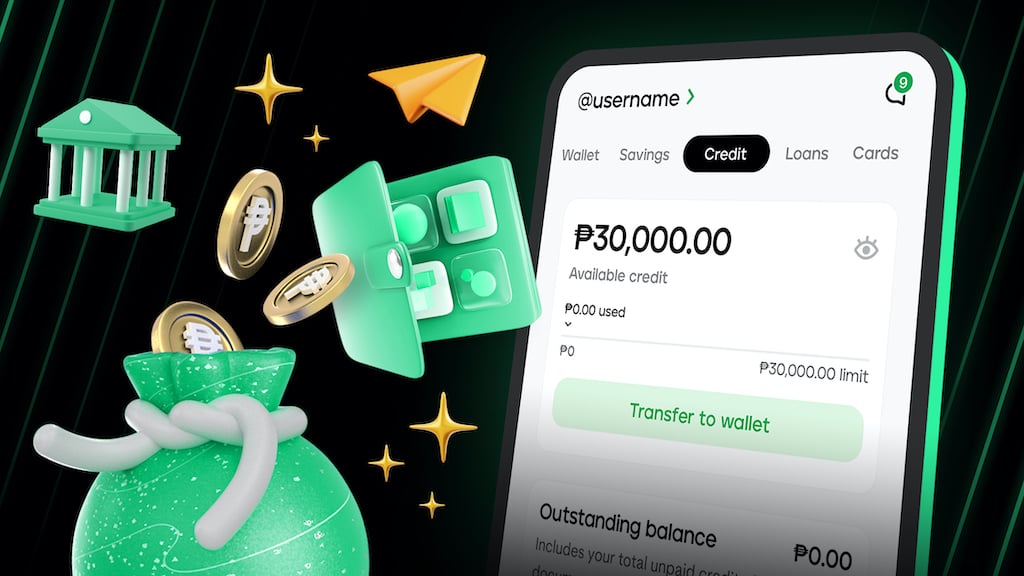

Instant Access to Cash When You Need It

Unexpected expenses can throw anyone off balance, but with this financial superapp, you don’t have to dip into your savings. Maya Easy Credit offers a revolving credit limit of up to PHP30,000 with instant approval, so you can access funds quickly and easily. For larger financial needs, Maya Personal Loan provides up to PHP250,000 with no collateral required, credited directly to your Maya Wallet. It’s financial flexibility, simplified.

Ready to Declutter Your Financial Life?

It’s time to stop juggling and start thriving. Download Maya, upgrade your account, and experience the ease of managing all your finances from one powerful app. Whether you’re aiming to boost your savings, diversify your investments, or simply keep better track of your spending, the superapp is here to help you achieve your goals—without the hassle. Visit maya.ph and mayabank.ph and follow @mayaiseverything on Facebook, Instagram, YouTube, and TikTok, and @mayaofficialph on Twitter for more details.