Salmon, a fast-growing financial technology company committed to responsible innovation and financial inclusion, has finished the development and deployment of its proprietary in-house payment orchestration platform to power transactions across its lending and savings products. Designed for speed, resilience, and scale, the platform ensures 99.9% uptime, a 99% QR Ph payments success rate, and consistently high user satisfaction, reflected in Salmon’s 4.8 rating in both the App Store (15,000+ ratings) and Google Play (56,000+ ratings).

The AI-powered payment infrastructure supports all transactions within Salmon’s ecosystem — including loan repayments, deposits, and fund transfers — by connecting seamlessly with a wide network of local banks, e-wallets, and payment providers.

Unlike a standard payment gateway, Salmon’s proprietary platform uses real-time routing, automatic fallbacks, and smart retries to maintain transaction reliability in the face of network issues or downtime. For customers, payments “just work,” with industry-leading uptime with no need to retry or wait for resolution.

“In financial services, reliability is everything,” said Raffy Montemayor, co-founder of Salmon. “We’ve invested in building a platform that ensures payments are fast, secure, and seamless, whether they happen in-app or at a partner store. Our goal is simple: customers should never have to think twice about whether a payment will go through.”

The platform features real-time routing with automatic fallback, allowing it to detect downtime or errors and instantly switch to alternative providers without any action from the customer. Its auto-debit capability is paired with advance reminders and multiple payment attempts, helping reduce missed payments while keeping customers informed at every step.

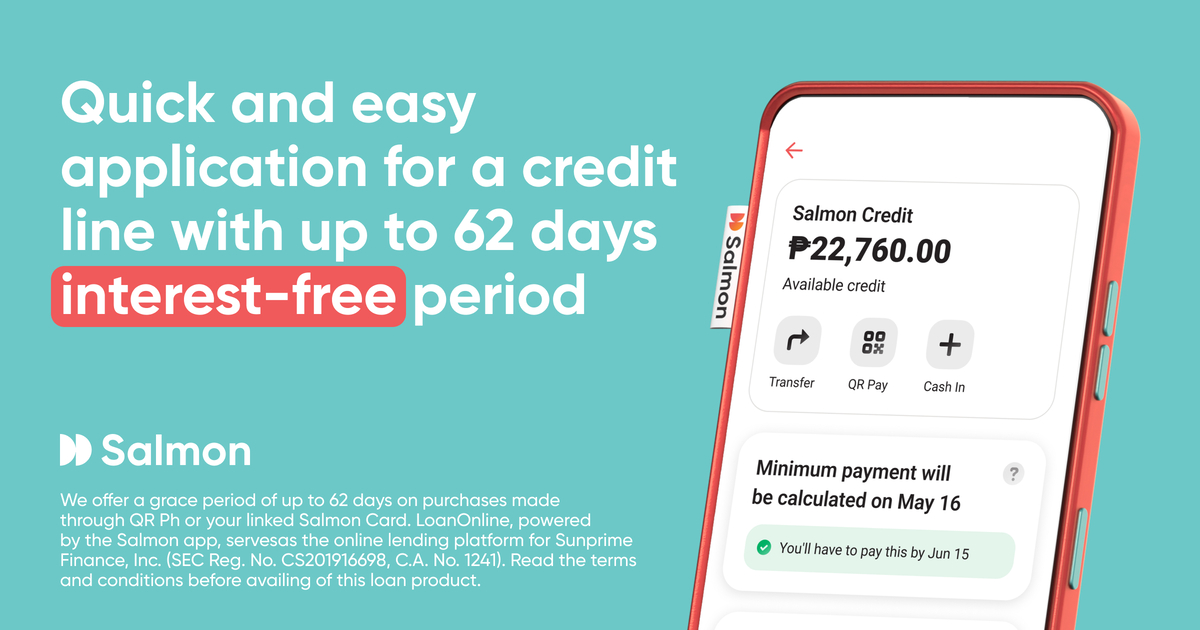

As one of the early adopters of QR Ph in the Philippines, Salmon offers both scan-to-pay and generate-QR options in-app, supporting the BSP’s push for nationwide payment digitalization and driving strong repeat usage among customers. To further protect transactions, the system incorporates robust payment safety mechanisms, including duplicate charge prevention, timeout handling, and the use of ISO 20022-certified payment rails to ensure data quality and reliability across channels.

Customers can pay directly through the Salmon app or via external partners such as e-wallets, banks, kiosks, and over-the-counter locations. All payments are automatically reconciled to the correct account, ensuring a smooth and worry-free experience.

The platform focuses on real-time posting, resilience, and security, helping boost repayment performance and strengthen customer trust— critical elements as Salmon expands its reach in the Philippines.

“By owning our payment infrastructure, we can continuously optimize for both customer experience and operational efficiency,” Montemayor added. “This is a core part of how we scale responsibly while keeping trust at the center of our business.”

With its in-house platform, Salmon is not only enabling faster, safer, and more convenient payments, it is also laying the groundwork for future innovations in financial services, further supporting its mission to provide inclusive, transparent, and reliable financial tools for the emerging middle class.