The newly rebranded Bayad, the country’s biggest and widest multi-channel payment platform, recently joined hands with Traxion Tech, a blockchain-powered system integration company, to serve the need for digital financial services in view of continuing quarantine restrictions and disruptions in business operations.

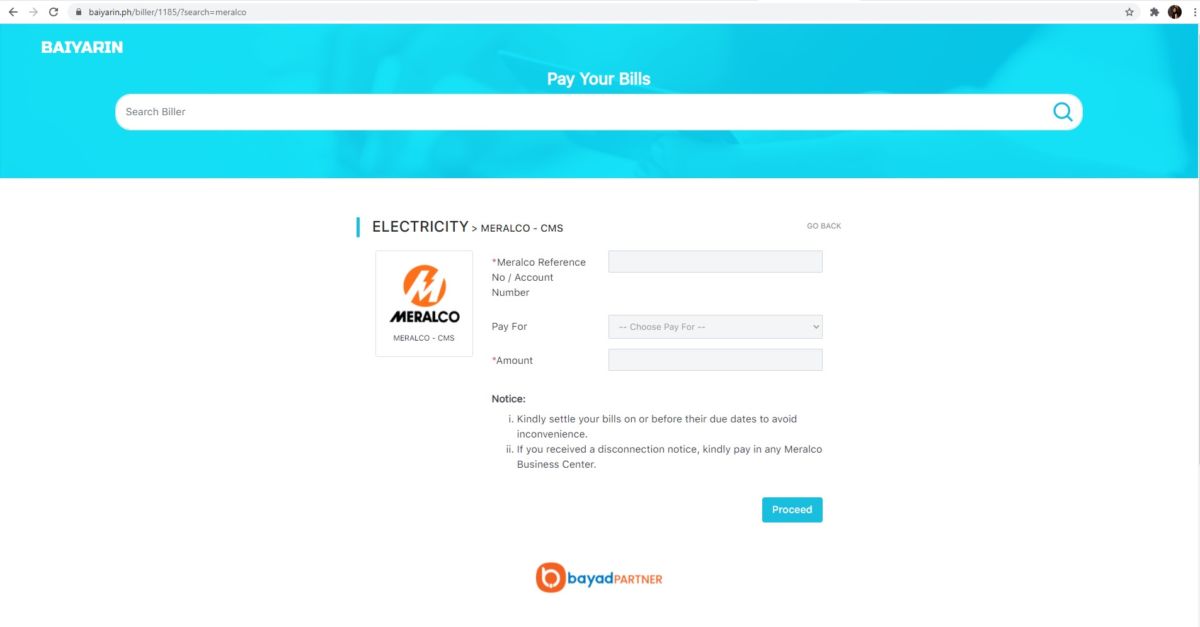

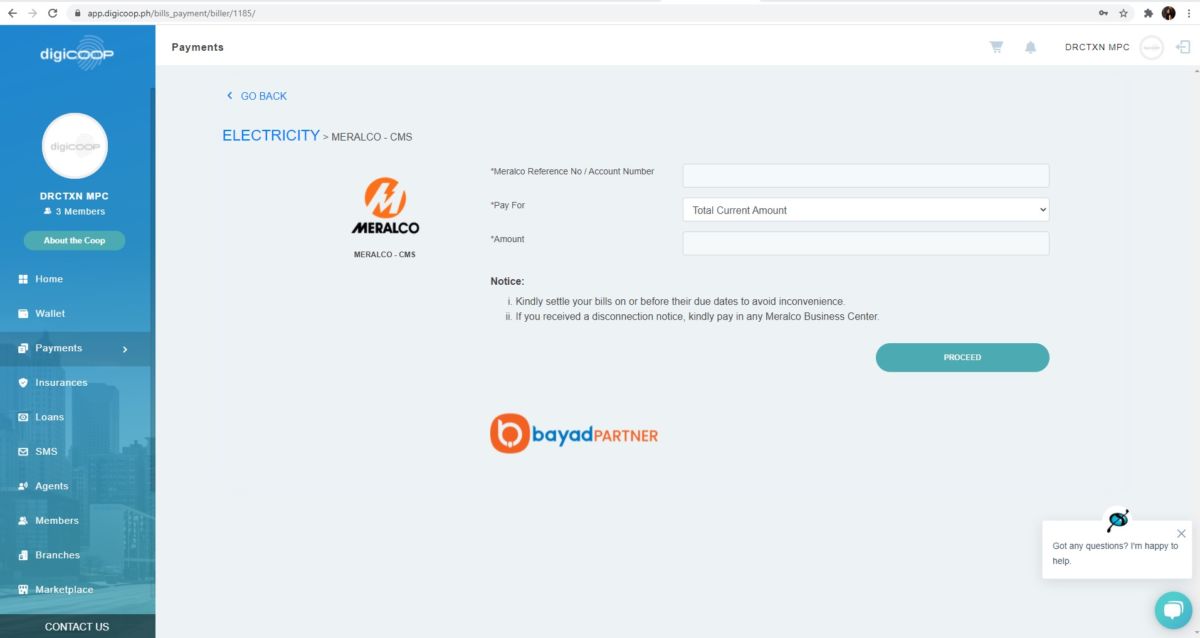

Ultimately, both companies aim to bring financial services closer to marginalized sectors and bridge the digital divide among consumer groups. Bayad is powering the bills payment capability of Traxion Tech’s products such as DigiCoop, a digital platform developed for cooperatives and its members to achieve financial freedom; Baiyarin, a billing and payment platform for billers and consumers; and Traxion Pay, a payment platform for small and medium enterprise (SME) owners aggregating numerous online and offline payment facilities.

Under the partnership, users of DigiCoop products and services will now be able to pay over 1,000 types of bills and have access to Bayad’s extensive network of partner billers. Together, the two institutions endeavor to ensure that the most underserved segments of society get to harness the benefits of transformative technologies. They believe that going digital is the way to weather the ongoing crisis and build resilience for a post-pandemic world.

“This is great news for cooperatives and SMEs. On top of delivering payment convenience and security, we want them to appreciate and get comfortable with fintech solutions and learn how to maximize their full potential,” Traxion tech chief executive officer Ann Cuisia shared.

“We want more Filipinos to be able to participate in the growing digital economy despite the setbacks posed by the COVID-19 situation. It is our enduring goal to support the underserved segment such as cooperatives and SME markets in grassroots communities by making financial services accessible and responsive to their needs. We know it is imperative to ensure business continuity so we are giving them means to digitalize key business aspects and leverage opportunities using online platforms,” said Lawrence Y. Ferrer, president and CEO of Bayad.

Ferrer added that the partnership with Traxion Tech underscores Bayad’s rebranding thrust to be bigger, better, and younger by continuously expanding its service and solutions portfolio, biller and channel partner network, as well as onsite-to-online platform.

Currently, Bayad has over 49,000 payment touchpoints nationwide and is further intensifying its digital footprint by powering fellow fintech players like Traxion Tech while strengthening its mobile and online payment platforms, the Bayad App and Bayad Online.