Maya, the #1 Digital Bank App in the Philippines, has launched Maya Time Deposit Plus, a game-changer savings product offering high returns and unparalleled flexibility, ideal for progressively building savings or efficiently managing their current funds.

Starting January 5, 2024, users can revolutionize their savings strategy by opening Maya Time Deposit Plus accounts. Users can now set a savings goal, begin with any amount, and select a term that aligns with their financial aspirations. This level of flexibility is unprecedented in traditional time deposits.

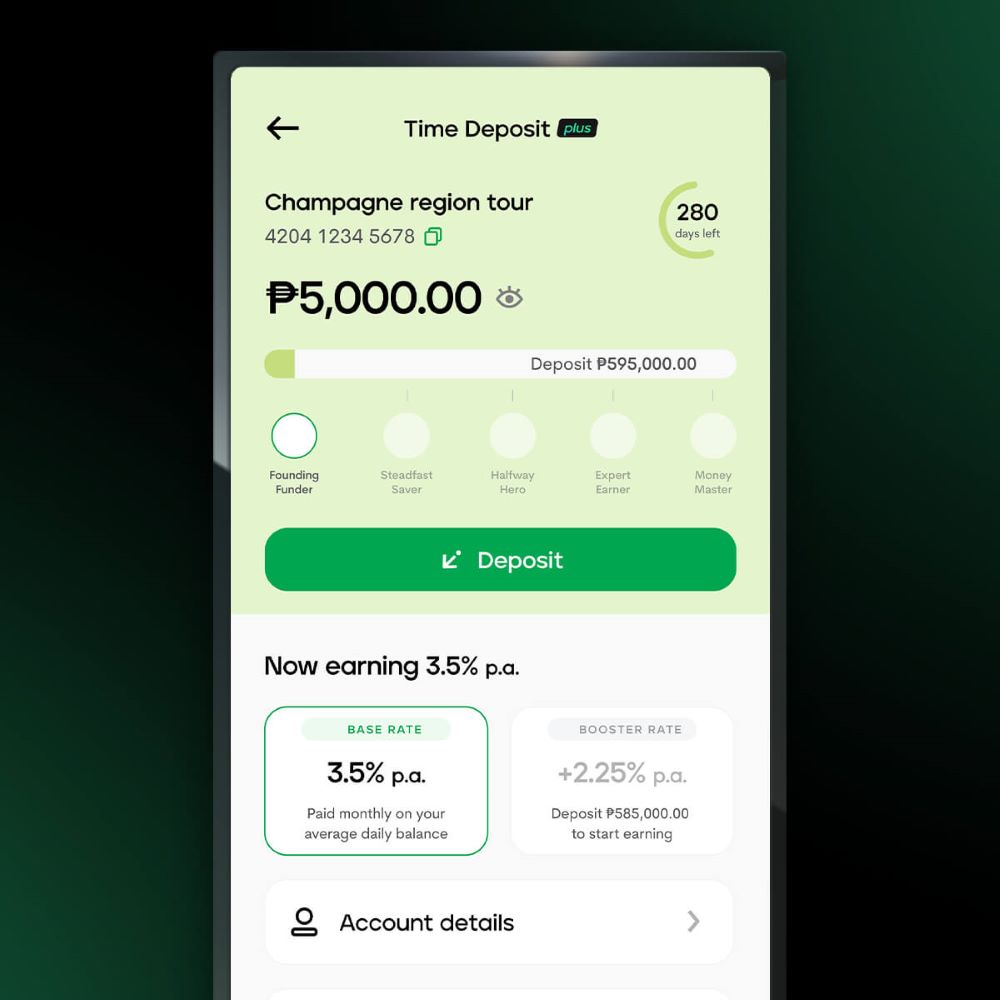

This innovative approach allows users to steadily enhance their savings while enjoying attractive rewards with interest rates of up to 6% p.a. Customers can open up to five Time Deposit Plus accounts with a maximum balance of PHP1 million per account, with the convenience of having interest credited monthly directly into their accounts.

Unlike anything in the market, this new savings product empowers users to set a target amount and strategically accumulate savings to reach it. It’s designed for all, whether starting with a large sum or growing savings bit by bit.

Customers can select a term option that aligns with their financial plans: three months at 5.50% p.a., six months at 6.00%, or 12 months at 5.75%. Further enhancing its flexibility, it allows instant cancellations, granting immediate access to funds whenever needed. Cancellation fees may apply, so be sure to read the terms and conditions.

Transferring funds to the Maya Time Deposit Plus account is seamless, directly from the Maya Wallet for free or via other channels like InstaPay or PESONet.

In a first for the industry, Maya introduces an innovative motivational tool where users can earn badges. These badges serve as milestones that visually track and encourage progress in the Time Deposit Plus journey, adding a layer of engagement to the saving experience.

“Maya is dedicated to improving the financial well-being of Filipinos. Our all-in-one digital bank app simplifies wealth-building, making it more effortless and rewarding. The Maya Time Deposit Plus represents our latest innovation to make financial growth widely accessible and empowering for all,” stated Shailesh Baidwan, Maya Group president.

Beyond savings, Time Deposit Plus is integrated into a broader ecosystem designed to nurture wealth growth. As users accrue earnings, they have the opportunity to reinvest in diverse financial services like Maya Funds, Stocks, and Crypto or facilitate daily transactions — all through the all-in-one Maya app.

Moreover, regular interactions with the app enhance users’ financial profiles, potentially opening doors to additional borrowing opportunities.

Maya is supervised by the Bangko Sentral ng Pilipinas, and its Time Deposit Plus provides a secure and dependable option for savings, reinforced by comprehensive security protocols and insured up to PHP500,000 by the Philippine Deposit Insurance Corporation (PDIC).

Ready to transform your savings? Maya is the #1 Fintech Ecosystem in the Philippines, with Maya, the #1 Digital Bank, and Maya Business, the #1 Omni-Channel Payment Processor. For more information about Maya, visit maya.ph and mayabank.ph. Stay updated on Maya by following @mayaiseverything on Facebook, Instagram, YouTube, and TikTok.