2025 was a defining year for technology. Artificial intelligence continued its global push, becoming deeply integrated into everything from smartphones and smartwatches to early previews of smart glasses. In mobility, the local market revealed a clear shift. While electrification continued, many consumers remained hesitant to go fully electric, opting instead for the best of both worlds: hybrids.

Finally, 2025 marked a turning point for the country’s fintech sector. NFC payments began rolling out at scale, while Google activated Google Wallet and Google Pay locally, delivering a major boost to the Bangko Sentral ng Pilipinas’ push toward a cash-lite economy.

As we head into the new year, even more changes are on the horizon. From consumer tech to mobility and fintech, here are our key predictions for 2026.

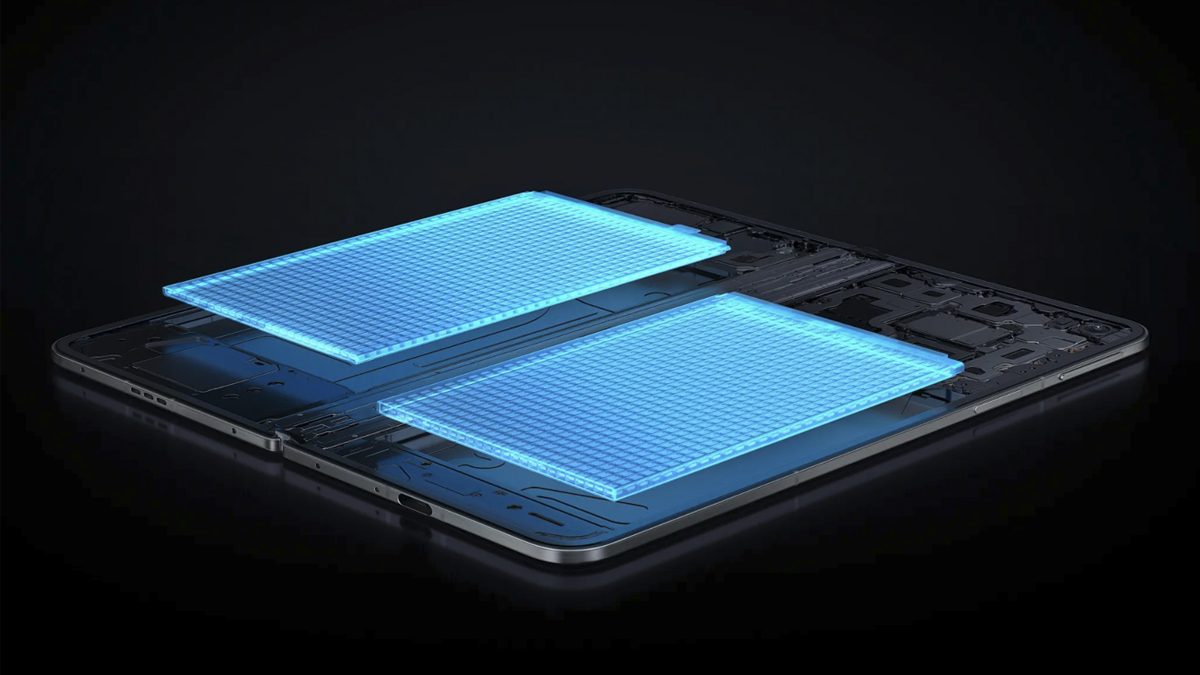

Smaller, sleeker tech, powered by better batteries

One of the quieter but most impactful breakthroughs of last year came in battery technology. The arrival of more smartphones powered by Silicon-Carbon (Si/C) lithium-ion batteries shook up the market. Compared to traditional graphite-based batteries, Si/C batteries offer higher energy density, allowing manufacturers to pack more capacity into slimmer designs.

This shift paved the way for thinner, lighter phones that still deliver impressive battery life. In 2026, we expect Si/C batteries to become the standard not just for midrange devices, but even for flagship smartphones. It will be a year where physical size records are broken and battery life finally becomes a design priority rather than an afterthought.

AI at the center of wearables and the smart home

Whether users embrace it enthusiastically or reluctantly, AI is here to stay and will be central to the tech we wear and use at home.

Last year offered a glimpse of what truly smart glasses could become. Google and Meta both showcased working prototypes, with Meta taking a step further by releasing its first consumer-ready models. At the core of these devices is AI. Google also began integrating its Gemini AI into Wear OS, signaling deeper intelligence for Android-based smartwatches.

In 2026, AI will continue to act as the brain behind wearables. We expect more advanced AI-driven features in smart rings, fitness bands, and health-focused devices, enabling more accurate tracking, predictive insights, and personalized recommendations. Beyond wearables, AI will increasingly shape smart home ecosystems, improving everything from appliance efficiency to home security and automation.

Electrification continues, just not the way we expected

The past few years have seen rapid electrification in the local automotive market. From BYD’s meteoric rise to Tesla’s arrival in late 2024, and Toyota’s long-awaited full EV launch at the end of 2025, momentum has been undeniable.

Yet 2025 also revealed a clear shift in buyer behavior. Rather than fully committing to electric vehicles, many consumers gravitated toward hybrids. Several factors contributed to this trend: rising fuel prices, improved fuel efficiency, and the practical benefits hybrids offer without the range anxiety often associated with EVs.

Pricing also played a significant role. Over the past year, hybrids and EVs entered the market at increasingly competitive price points, in some cases undercutting traditional internal combustion competitors. As charging infrastructure continues to develop, we expect hybrids, particularly full hybrids and plug-in hybrids (PHEVs), to remain the dominant choice in 2026 as buyers prioritize convenience, flexibility, and overall value.

Fintech goes fully tap-to-pay

If one sector clearly led the way in 2025, it was fintech. The year saw several milestone launches, including mobile NFC payments for local e-wallets and banking apps, digital payment systems for MRT and other transport lines, and the official rollout of Google Wallet and Google Pay in the Philippines. Together, these developments significantly accelerated the country’s shift toward a cash-lite economy.

Another major development was the BSP’s approval of both Google’s and Apple’s NFC payment platforms. Google entered the local market in November, while Apple is now cleared to launch its own solution at any time. With regulatory hurdles resolved, there is a strong likelihood that Apple Pay will finally arrive in 2026.

As these global tap-to-pay platforms gain traction, demand for contactless payments is expected to surge. Supporting this growth, e-wallets like GCash and banks such as RCBC have already launched mobile POS solutions, enabling small businesses to turn smartphones into payment terminals capable of accepting both NFC and card-based transactions.

Look Ahead

2026 is shaping up to be a year of refinement rather than radical reinvention. Smaller devices with bigger batteries, AI-driven intelligence across wearables and homes, practical electrification through hybrids, and widespread tap-to-pay adoption all point to one theme: technology designed to fit more naturally into everyday life.

If 2025 laid the groundwork, 2026 will be the year these technologies truly become part of the mainstream.

Words by Gabriel Pe

Also published in GADGETS MAGAZINE Volume 26 Issue No. 6