Cashalo, the fintech company working to accelerate financial inclusion for every Filipino, today introduced a first-of-its-kind ‘pre-approval’ feature for its digital credit solution—Cashacart; making it even easier for unbanked and underserved consumers across the Philippines to access the credit they need and improve their lives.

According to the BSP’s latest Financial Inclusion Survey conducted in 2017, over 77% of Filipinos remain unbanked and over 40% of borrowers obtained their funds from informal sources. And according to Ms. Rose Ong, president of the Philippine Retailers Association, the share of online shopping in the country was only about 1-2% of total retail sales, and according to research by RF Group, 80% of online sales are still cash on delivery.

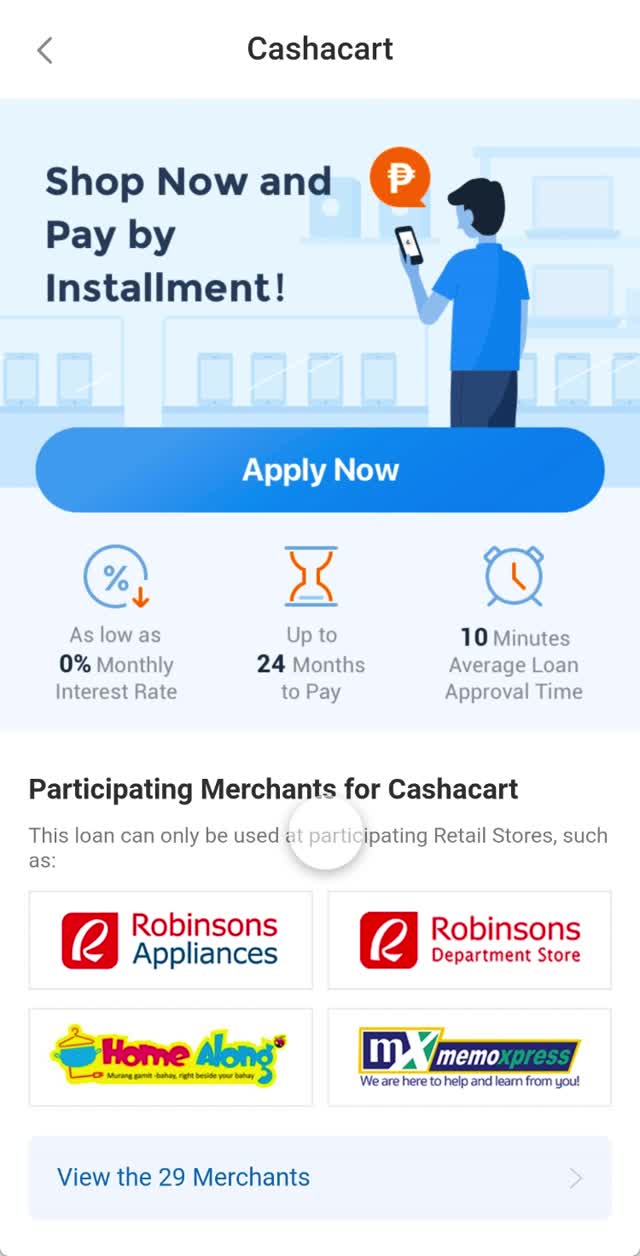

Cashacart, the country’s first true ‘online-to-offline (O2O) basket financing’ offering, is designed to give underserved consumers the unrivalled ability to finance a variety of products or a ‘basket’ of goods using digital credit. With it, you can now get pre-approved for digital credit in the Cashalo-app even before you visit a store and purchase a variety of products or ‘basket’ of goods.

“We built the Cashalo app with a simple mission—to unlock financial access for every Filipino, especially those that need it most, from unbanked and underserved communities,” said Hamilton Angluben, general manager of Cashalo. “Our data shows that the vast majority of Filipinos not only prefer the offline retail experience, but are more active in that space, but aspire to benefit from the convenience of online payments.”

With this first-of-its-kind feature, Cashalo is empowering consumers with the knowledge and tools to better plan and manage their finances more responsibly. With the new feature, consumers now have:

- complete visibility of their working budget in advance (ranging from PHP 2,250 – 19,999) and applicable interest rates (as low as 0-4%),

- total control over their repayment schedules (monthly installments)

- a decision in as fast as 24 hrs so they can plan their schedule

- access to a growing network of over 300 Cashalo merchant partners (including Cherry Mobile, Memoxpress, Robinsons Appliances, Robinsons Department stores, Blade, Spyder, Mi Department stores and Uno Factory outlets)

“We are creating tremendous sales value for our merchant partners, empowering consumers with easier access to digital credit, payment and financing solutions on-the-go, and helping previously credit-invisible Filipinos build financial identities and participate in the formal economy for the first time,” added Angluben.

Cashacart is one of a comprehensive suite of financially inclusive products available via the Cashalo mobile-app, which has already helped hundreds of thousands of Filipinos unlock their financial potential. The company now has a customer base of over 1.3 million Filipinos, with the Cashalo app in the phones of more than 3 million users and counting.

Cashalo is a fintech platform that provides access to various financial services, and is committed to building a more financially inclusive future for all Filipinos. The Cashalo app for Android and iOS underwrites customers within minutes using alternative data points to deliver fast, convenient and secure access to credit, on-demand. To learn more, please visit http://www.cashalo.com