After all the big advances in technology, it’s no surprise that the banking industry has adapted to keep up with progress. Financial institutions have digitized processes and even developed modern, feature-packed apps to make services more accessible to an ever-growing customer base.

As an industry leader, PSBank continues to sharpen its focus to promote the utilization of electronic channels. Its efforts are in support of the Bangko Sentral ng Pilipinas’ goal to increase the adoption of digital transactions in the country. The Bank’s recently-upgraded Mobile App, for instance, is designed for effective, safe, real-time banking – offering a full suite of innovative services with easy-to-navigate enhancements and security features that allow its customers to focus on the moments that truly matter.

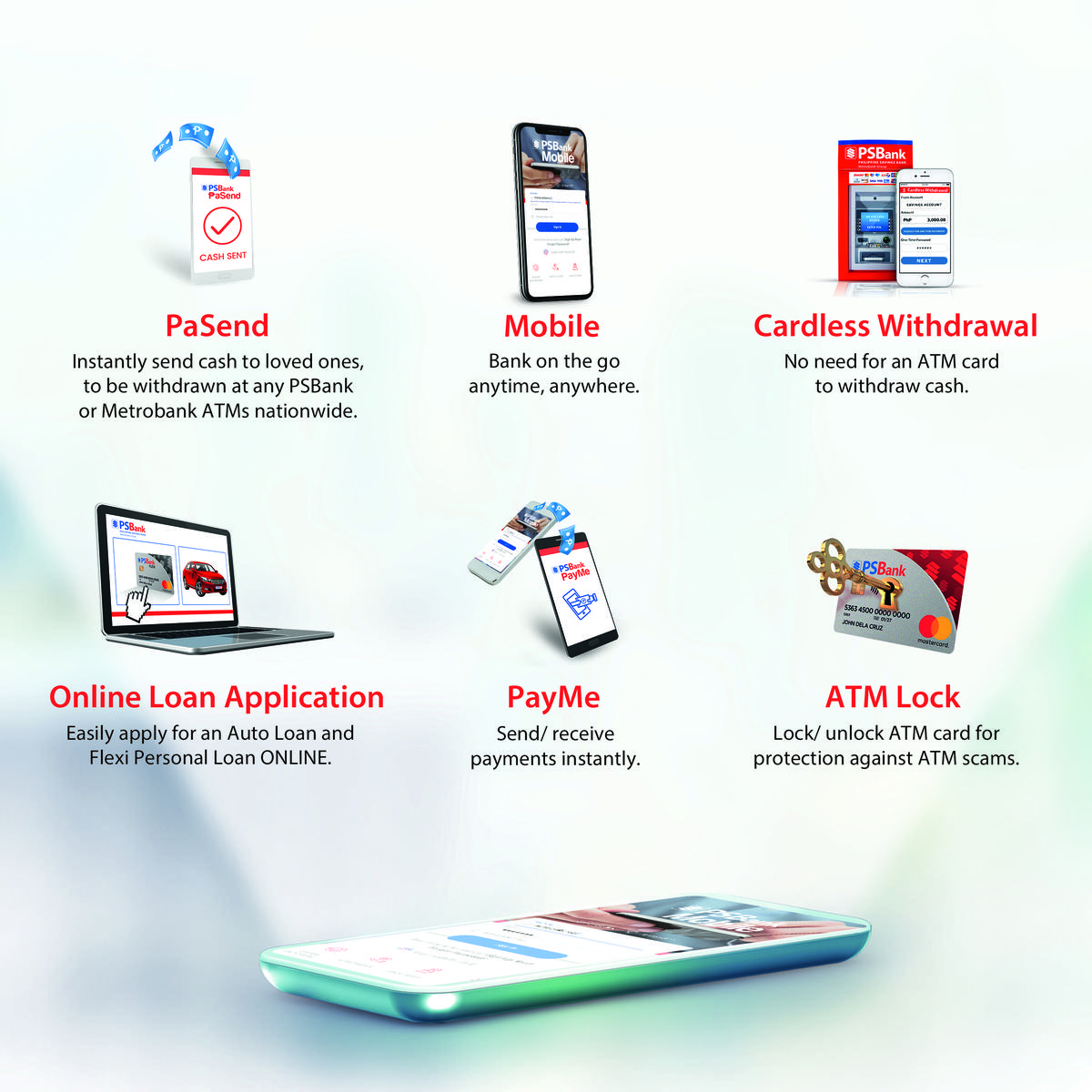

Here are five reasons on why you should try out the PSBank Mobile App and its services, and make the switch to e-banking and e-payments today:

1. It’s quick and easy. With just a few taps and scrolls on your smartphone, you can transfer funds, pay loans and bills, and perform other on-the-go transactions. Payments are always done in real time so your banking needs can be settled within minutes.

2. It accepts payment for a wide range of services. The PSBank Mobile App can process payments for multiple services, including utilities, telcos, cable and internet, travel, credit cards, insurance, schools, and more. Through the App, users can also request for cash using PayMe, an innovation that allows the payment of dues to other users or the requesting of payment from others.

3. It’s convenient. You can send money anytime, anywhere. You can send cash to friends and loved ones without ever having to go to a remittance center through PSBank’s PaSend service – now also available in-app. Beneficiaries can secure the funds fast simply by going to any PSBank or Metrobank ATM to withdraw. They don’t even need an account with the Bank!

4. It’s affordable. Most of the App’s functions are free – and even its PaSend comes at a much lower cost compared to other remittance services. Each transaction is only PhP 25, to be shouldered by the sender.

5. It’s secure. The PSBank Mobile App offers a Touch ID feature so you can access your account through fingerprint recognition. An in-app, one-time password adds a second layer of protection for users.

“Security and ease of use have always been thought to be at odds with each other,” shares PSBank first vice president and information security head Dan Duplito. “But in PSBank, we believe we found a good balance of the two in our PSBank Mobile App, providing accessibilty and ease to our customer’s online banking experience while giving them peace of mind that their accounts are secure with us.”

The Mobile App is just one of PSBank’s innovations to improve the banking experience of its customers. It also has made cardless withdrawals possible, enabling clients to easily get cash without an ATM card. The thrift bank also introduced “ATM Lock,” a security feature that protects one’s account to prevent fraudsters from making illegal transactions.

For more information on how PSBank’s Mobile App, its focused digital innovations, and flexible e-payment options can make your life easier, visit www.psbank.com.ph.