With the growing penetration of online services in the country, a recent study conducted by the Robocash Group, an international finance company that provides microlending, shows the growing demand of Filipino Gen X and Baby Boomers on fin-tech companies.

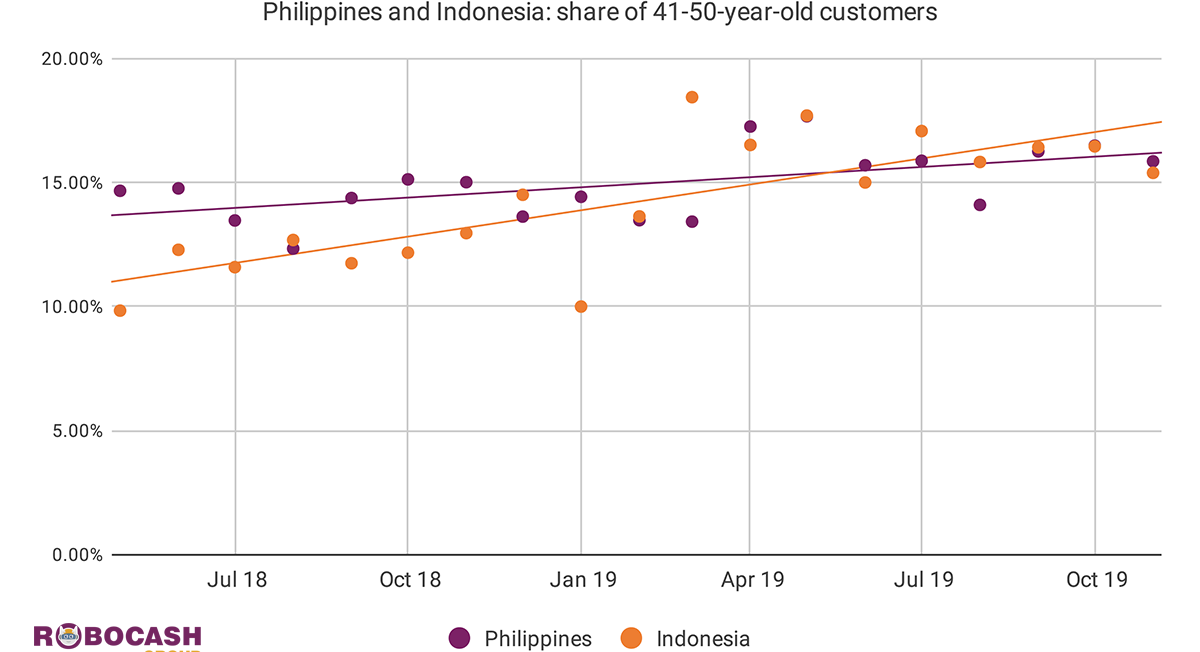

According to the research, which was compared against the similar trends identified in Southeast and South Asia, the Philippines took the top spot with the highest users on online lending services. The demographics of the users are reported to be part of the Gen X generation aging from 41 to 60 years old. It significantly increased from May 2018 (14.67%), amounting to 15.86% by December 2019 with a 1.2% increase of new users monthly.

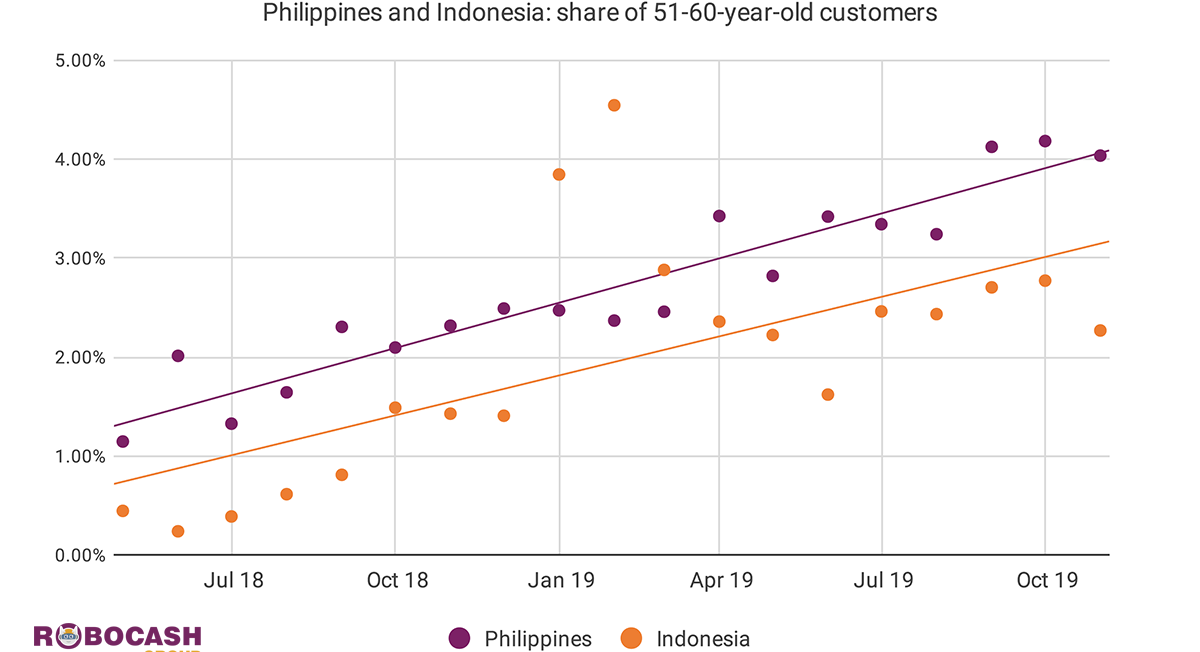

It also delivered the same results for its 51- to 60-year-old users which shows a rapid 5.6% growth monthly. By December 2019, it has hit 4% compared to 1.15% in May 2018. Robocash Group analysts said that the main driver for this switch is territorial fragmentation, as well as the youth’s influence on trying alternative fin-tech options.

Indonesia took second place, reaching a total of 15.39% Gen X users by December 2019. This significantly shows a greater average growth compared to the Philippines with 1.8% in this age group. Meanwhile, the share of 51- to 60-year-olds still lags significantly with 2.27% despite its monthly increase of 5%.

Vietnam and India shared similar trends but had higher dynamics. Thus, the share of older Indians taking online lending services grew on average by 8.3% per month. Vietnam, on the other hand, outpaced it with a monthly rate of 26%.

Robocash noted that the popularity of fin-tech services in Vietnam will keep increasing. However, older generations are still hesitant users with 4.63% in Vietnam (2.71% in January 2019) for 41-50-year-old clients by December 2019. It also meant the same for India with 9.33% (4.44% in January 2019). Moreover, the share of customers aged 51-60 years in Vietnam in January 2019 was only 0.08%, while India recorded 0.44%. Over the year, these countries grew to 0.82% and 0.99%, respectively. Factors such as the maturity of the population in Vietnam (30.9 years) and the insufficient penetration of banking services (30.8%) affected the results, which were the lowest among the mentioned countries.

This denotes that despite the steadily growing use of fin-tech platforms by Asian Gen X and Baby Boomers, the gap remains uncovered. Further development of financial technologies in Asian countries can significantly enhance economic activity, driving inclusive growth across the region.