Rollout of 5G services could boost annual revenues of Philippine telecom operators by as much as 650 million dollars starting 2025, according to a new study commissioned by Cisco, a global technology leader.

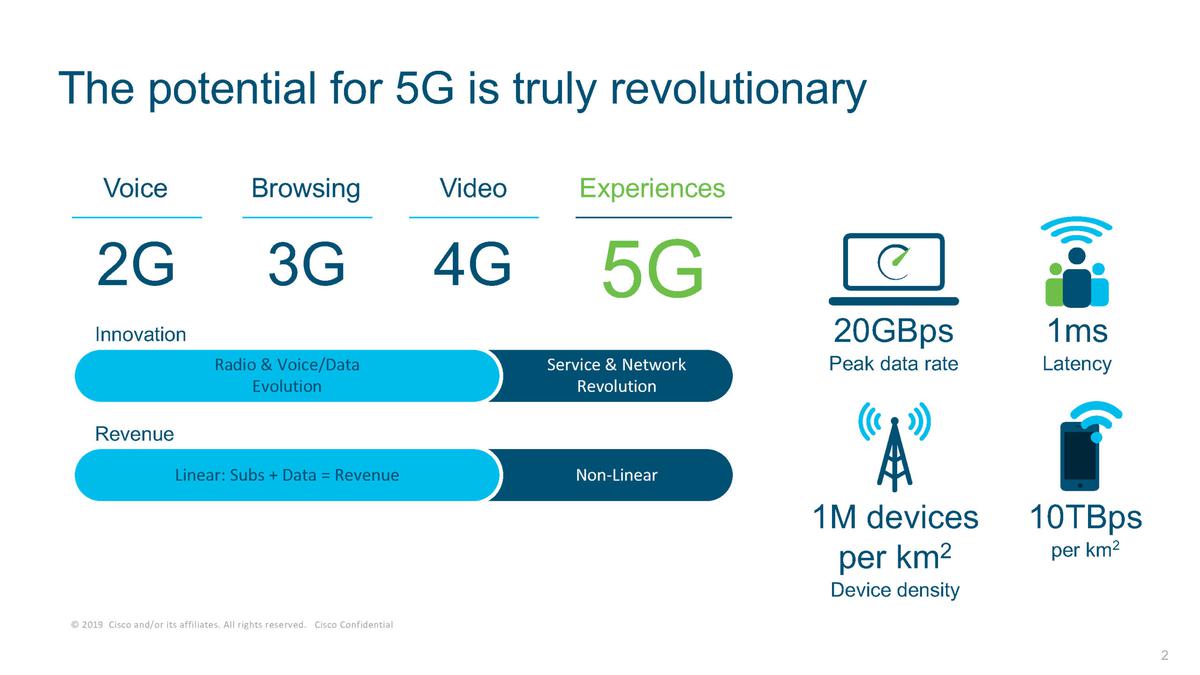

The study, conducted by management consulting firm Kearney, highlights that 5G promises speeds up to 50 times faster, 10 times more responsiveness, and much lower power connectivity than 4G. This will be driven by a combination of three distinctive features — high throughput, ultra-low latency, and low power connectivity.

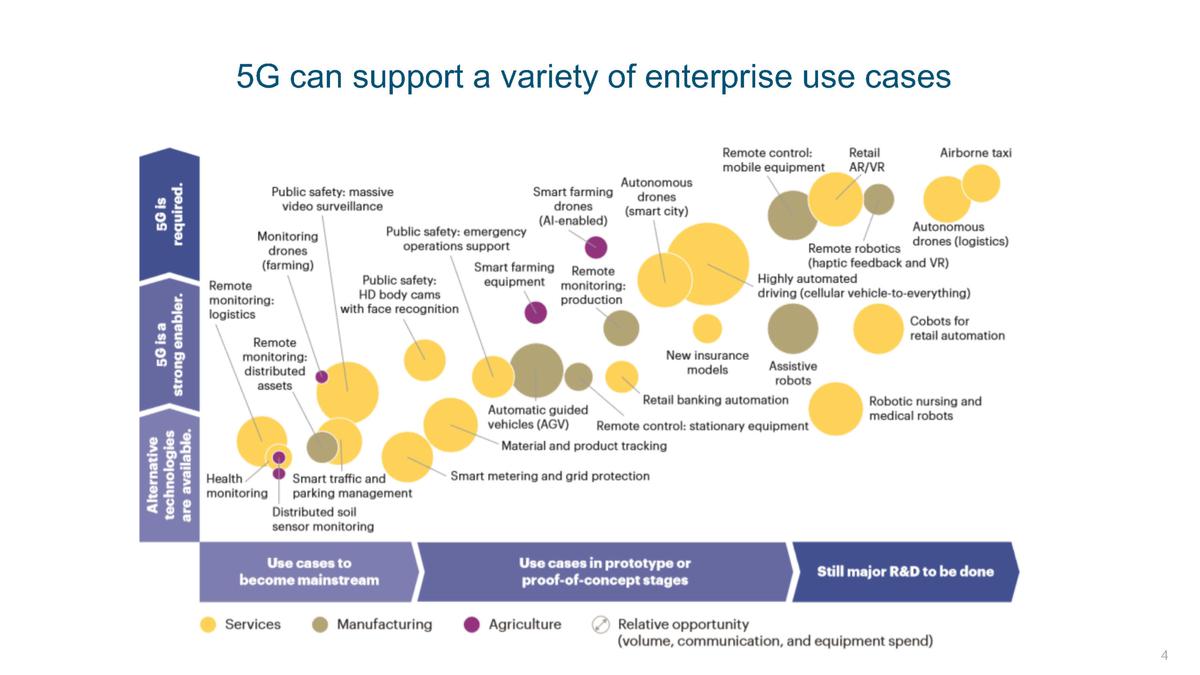

Speed, low latency, and enhanced connectivity will help telecom operators provide super-fast Internet connections that enable streaming of high-definition videos, cloud gaming and delivery of interactive augmented and virtual reality (AR/VR)-powered content to consumers. It will also help to fast-track the commercialization of several advanced use cases of 5G, including smart cities, Industry 4.0, large-scale Internet of Things (IoT) deployments, and more. This will enable telecom operators to increase revenues both from consumers as well as enterprise clients.

Titled, 5G in ASEAN: Reigniting growth in enterprise and consumer markets, the study states that initial growth of 5G adoption is expected to come from high-value customers and high-value devices, and subscriptions will start to scale as devices become more affordable.

As a result, the study expects 5G penetration to be around 25 to 40 percent in major countries in the region by 2025, with Philippines seeing nearly 15 percent penetration. The total number of 5G subscriptions in ASEAN is forecast to exceed 200 million in 2025.

Naveen Menon, president ASEAN at Cisco, said: “The expected rollout of 5G services comes at a perfect time for telecom operators. The usage of cellular data is growing rapidly as users consume increasing amount of services and content on their personal devices. At the same time, enterprises are looking to leverage the Fourth Industrial Revolution (4IR), which is underpinned by Artificial Intelligence, IoT, 3D Printing, Advanced Robotics and Wearables, to boost growth. The successful adoption of these technologies is largely dependent on the underlying connectivity. This provides a huge opportunity for telecom operators to increase their presence in the enterprise market and sustain their long-term growth.”

Karrie Ilagan, managing director for Philippines at Cisco, said: “Digital transformation has been a big theme in the Philippines. Businesses across the country, are looking to leverage advancements in 4IR technologies to enter a new phase of expansion. The rollout of 5G services will play a key role in accelerating the adoption and bring substantial benefits to the enterprises. At the same time, consumers are also eagerly waiting for 5G rollout for enhanced experience with content consumption on their personal devices. The Philippines is already a global leader in social media usage and Filipino consumers are spending billions of dollars on online shopping. The rollout of 5G services will not only give them better experience but also increase the reach of digital connectivity across the country. Together, these trends will play a key role in boosting Philippines’s economic growth in the coming years.”

As telecom operators get ready to roll out 5G services, they are likely to invest about US$10 billion into the region’s 5G infrastructure by 2025.

Dharmesh Malhotra, managing director ASEAN, service provider, at Cisco, said: “The rollout of 5G services will require substantial investments in technology to modernize underlying networks. In ASEAN, telecom operators are likely to continue to invest in upgrading their 4G networks and build the 5G capabilities in a phased manner. This will allow 4G and 5G to operate simultaneously and help the operators manage their capex and ROI in a sustainable manner. Cisco is partnering with network operators in their journey to 5G rollout and is already engaged with customers in ASEAN on 5G transformation”.

The study highlights that to unlock this potential, the region needs to address some key challenges.

Foremost among these is the slow availability of spectrum for 5G services and the resulting suboptimal network rollout. 5G will be deployed across multiple bands, with three bands likely to be important globally in the near-term: low band (700 MHz), mid-band (3.5 to 4.2 GHz), and high-band on mmWave spectrum (24 to 28 GHz). In ASEAN, many of these bands are already being used to provide other services. Low band is being used for FTA TV, and mid-band is being used for satellite services. Although mmWave bands are available, deployment will need to be combined with low band spectrum to enable an economically viable coverage of suburban and rural areas as well as in-building access.

In addition, operators will need to carefully construct their 5G product and pricing portfolios and migrate consumers to the high-speed network. Consumers are excited about 5G and are willing to pay for better quality, unlike 3G and 4G technology. It would be fatal for operators to engage in a price war just to attract a higher number of subscribers in the hope they can charge them more at a later stage.

On the enterprise side, operators will need to build new capabilities and bundle enhanced connectivity with solutions and applications to help customers understand, implement, and scale up value-enhancing use cases. They will also have to contend with a new set of competitors that provide private networks to enterprises.

Nikolai Dobberstein, partner at Kearney and a lead author of the report, said: “The overall potential of 5G rollout in ASEAN is substantial. However, to live up to the full potential, the region will need to address the main challenges. This will require a coordinated effort from all stakeholders — regulators, operators, and enterprises. Given the ecosystem challenges and the large value at stake, regulators will play a central role. Among the key issues that regulators would need to take the lead on are: ensuring near-term spectrum availability, fostering infrastructure sharing and nurturing the development of national cybersecurity capabilities across the region.”