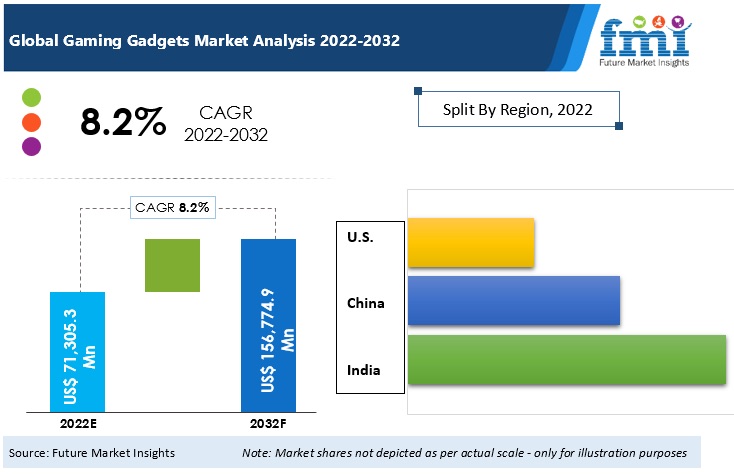

The global gaming gadgets market is booming with an estimated valuation of USD77,009.4-million in 2023 and USD169,316.9-million by 2033. The demand for gaming gadgets is anticipated to rise at a CAGR of 8.2% from 2023 to 2033.

Southeast Asia has played a significant role in the growth of the global gaming gadgets industry. In 2018, the Southeast Asia gaming gadgets market was valued at USD6,900.8-million. By 2022, it had grown to USD10,054.0-million, representing a CAGR of 9.9%. The market share of Southeast Asia in the global market is expected to rise from 14.3% in 2023 to 17.8% by 2033, demonstrating the region’s growing influence on the industry.

Gaming goes big: Southeast Asia’s explosive growth in the gaming gadgets market

The Southeast Asia gaming gadgets industry has been rapidly growing and is expected to continue its growth trajectory in the coming years. As per FMI research, the growth rate is expected to further increase, with a CAGR of 10.6% from 2023 to 2033. The gaming gadgets industry in Southeast Asia is estimated to be worth USD11,012.3-million in 2023 and is projected to surpass USD30,138.4-million by 2033.

Southeast Asian countries have a large and growing youth population, with a strong passion for gaming. This has fueled the demand for gaming gadgets in the region. To cater to the specific preferences of local gamers, companies are developing products that are tailored to the regional market. Localization is an important trend that is shaping the gaming gadgets industry in Southeast Asia. Localizing products, including language support and culturally relevant features, has helped companies to appeal to a wider audience and gain a competitive edge.

The growth of the Southeast Asia gaming gadgets industry has been aided by the contribution of the Philippines, which is one of the major markets in the region.

Leveling Up: The latest trends fueling growth in the Philippine gaming gadgets industry

The Philippines is one of the fastest-growing gaming gadgets markets in Southeast Asia. The market size in the Philippines was USD738.4-million in 2018, which is expected to reach USD1,332.5-million in 2023, with a CAGR of 12.6% during the forecast period. The market share of the Philippines in the Southeast Asia gaming gadgets industry is expected to rise to 14.1% by 2033.

DROTs of the Philippine gaming gadgets industry

Drivers

- Increasing popularity of esports and mobile gaming in the country.

- A growing number of young gamers with disposable income.

- Rising internet penetration and mobile phone ownership rates.

- Government support for the development of the local gaming industry.

Restraints

- High import taxes and limited availability of certain gaming gadgets.

- The low purchasing power among some segments of the population.

- Limited access to high-speed internet in some regions of the country.

Opportunities

- Growing demand for gaming smartphones, particularly those with high refresh rates and powerful processors.

- Increasing interest in virtual reality and augmented reality gaming.

- The growing market for gaming laptops, particularly those with powerful graphics cards and high refresh rates.

Trends

- Rise of gaming-oriented mobile devices: The popularity of mobile gaming in the Philippines has led to a surge in demand for gaming-oriented mobile devices like gaming smartphones, tablets, and accessories. This trend is expected to continue to grow, with the gaming gadget market in the Philippines expanding and new and innovative mobile devices being introduced to meet the needs of Filipino gamers.

- Gaming laptops: Gaming laptops have emerged as a crucial segment of the gaming gadget market in the Philippines, offering both power and mobility for gamers on the go. The trend of gaming laptops is expected to continue growing in the Philippines, particularly as more people turn to remote work and require portable gaming devices that can also be used for work purposes.

- High-quality gaming accessories: The demand for high-quality gaming accessories like gaming mice, keyboards, and headsets has grown in the Philippines as gamers seek to improve their performance and enhance their gaming experience. The gaming gadget market in the Philippines is expected to continue to expand as more gamers invest in high-quality accessories to enhance their gaming experience.

Significant developments made by major companies in the Philippines

- Asus launched its ROG Phone 5, a gaming smartphone with a 144Hz display and a Qualcomm Snapdragon 888 processor.

- Acer launched the Predator Triton 300 SE, a gaming laptop with a 144Hz display and an Nvidia GeForce RTX 3060 graphics card.

- HyperX expanded its range of gaming accessories in the Philippines, including headsets, keyboards, mice, and mousepads.

Key takeaways for the local gaming gadget market

- The gaming gadgets market in the Philippines has been on an upward trajectory, with a market size of USD738.4-million in 2018.

- Between 2018 and 2022, the market size grew to USD1,186.4-million, representing a CAGR of 12.6%.

- The market is expected to continue growing, with a projected CAGR of 12.3% from 2023 to 2033.

- By 2023, the market size is expected to reach USD1,332.5-million, and by 2033, it is projected to reach USD4,249.5-million.

- The increasing demand for gaming gadgets in the region is creating a highly competitive landscape in the Philippines.

Winning strategies: Inside the cutthroat world of gaming gadgets in the booming domestic market

The Philippines gaming gadgets market is a highly competitive space, with both local and international players vying for a slice of the market share. Some of the key players in the market include Acer, Asus, Lenovo, HP, and Dell, who are primarily involved in the production and sale of gaming laptops. In addition, gaming smartphone manufacturers such as Xiaomi, Realme, and ASUS have also entered the market, capitalizing on the growing demand for mobile gaming devices.

To grow their market share, players in the gaming gadgets industry are investing heavily in research and development to create innovative and high-quality products that cater to the unique needs of Filipino gamers. They are also focusing on expanding their distribution networks and partnering with local retailers and e-commerce platforms to boost their reach across the country.