The Fletcher School at Tufts University, in partnership with Mastercard, has unveiled the Digital Intelligence Index, which charts the progress economies have made in advancing their digitalization, fostering trust, and integrating connectivity into the lives of billions.

Building upon earlier editions in 2014 and 2017, this year’s index paints a picture of global digital development, sheds insight on key factors driving change and momentum, and unpacks what this means for economies facing the challenges of a global pandemic and post-pandemic future.

Notably across Asia Pacific, Singapore, Hong Kong SAR, South Korea, and Chinese Taipei are amongst the most digitally dynamic economies. South Korea and Chinese Taipei have significantly outperformed the OECD growth rate in Q2 2020 amidst the global lockdown. These economies feature high levels of available talent, active R&D collaboration between industry and academia, and a strong record of creating and bringing digital products into the mainstream.

Bhaskar Chakravorti, dean of global business at Fletcher, said, “The pandemic may be the purest test of the world’s progress towards digitalization. We have a clearer view on how dynamic digital economies can contribute to economic resiliency during a time of unparalleled global turmoil and can be positioned for recovery and change.”

Other key findings include:

- With nearly two thirds of the world’s population online today, we are entering an ‘after access’ phase, where access alone is not enough. Aspects such as the quality of access, effective use of digital technologies, accountable institutions, robust data governance policies and fostering trust are greater factors in determining digital competitiveness and sustainability.

- Young people in emerging economies are demonstrating high levels of digital engagement, a bright spot for governments attempting to expand digitalization in their economies.

Ajay Bhalla, president, Cyber & Intelligence, Mastercard said, “Never before has there been such an acute need to understand the factors that drive digitalization and digital trust. With that knowledge, businesses and governments can work together to help all 7.6 billion people around the world benefit from the vast opportunities a digitally advanced economy can bring. Whilst much remains uncertain today, it is clear that digital success will be a key building block in our collective recovery.”

A global outlook on digital evolution and trust

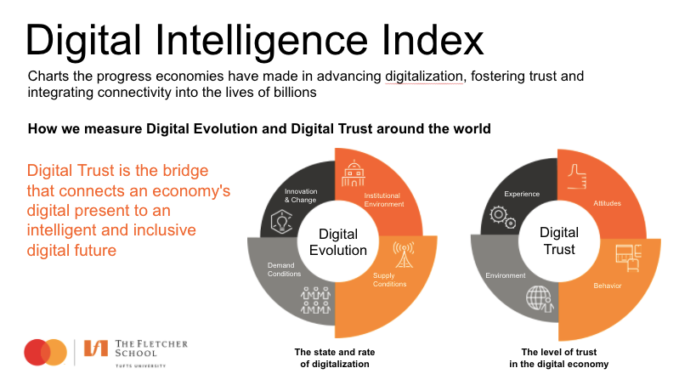

This year’s index looks at two components: Digital Evolution and Digital Trust. Digital Evolution captures an economy’s historical momentum from the physical past to the digital present. Digital Trust is the bridge that connects its journey from the digital present to an intelligent and inclusive digital future.

Mapping 95% of the world’s online population and drawing on 12 years of data, the Digital Evolution scorecard measures 160 indicators in 90 economies across four key pillars: institutional environment, demand conditions, supply conditions, and the capacity for innovation and change. These segment into four categories:

- Stand Out economies in Asia Pacific are Singapore, Hong Kong SAR, South Korea, Chinese Taipei, and Malaysia. They’re in this category alongside the United States, Germany, Israel, and others because they’re both highly digitally advanced and exhibit high momentum. They are leaders in driving innovation, building on their existing advantages in efficient and effective ways.

- Stall Out economies in Asia Pacific are Australia, New Zealand and Japan. These are noted as mature digital economies with a high state of digital adoption despite slowing digital momentum. They tend to trade off speed for sustainability and are typically invested in expanding digital inclusion and building robust institutions.

- Break Out economies in Asia Pacific include mainland China, India, Vietnam, Indonesia, and Thailand. These are evolving rapidly with momentum and significant headroom for growth that is highly attractive to investors.

- Watch Out economies – such as the Philippines – have a number of infrastructure gaps. Despite this, young people are showing enthusiasm for a digital future with increased use of social media and mobile payments.

The Digital Trust scorecard measures 198 indicators in 42 of the index’s economies across four key pillars: behavior, attitudes, environment, and experience.

- Economies such as Singapore, Hong Kong SAR, Chinese Taipei and South Korea provide citizens with a near seamless experience, delivering the holy grail of advanced infrastructure, broad access and unparalleled interaction. This experience is also matched by high levels of engagement, offering these economies a clear advantage in a ‘beyond access’ future.

- Economies such as mainland China, Indonesia and Vietnam have increasingly favorable attitudes about their digital future, buoyed by rapidly expanding digital adoption and opportunity.

- Overall, digitally advanced economies with higher levels of socio-economic equity expressed more positive attitudes towards digital technologies, while fast-moving Break Outs are more optimistic than their Watch Out peers.

“COVID-19 has advanced digitalization across Asia Pacific by at least five years in as many months, only serving to further accelerate the development of the digital ecosystems across the region. With rising levels of consumer trust and engagement and growing digitization in the small business segment, all deeply supported by proactive enabling actions from governments, the opportunities ahead for the region’s digital economy are immense. With Asia Pacific poised to recover quickly from the pandemic, the strong performance in the two components of Digital Evolution and Trust will only serve to further support Asia’s leadership in digital.” Matthew Driver, executive vice president, services, Asia Pacific, Mastercard.