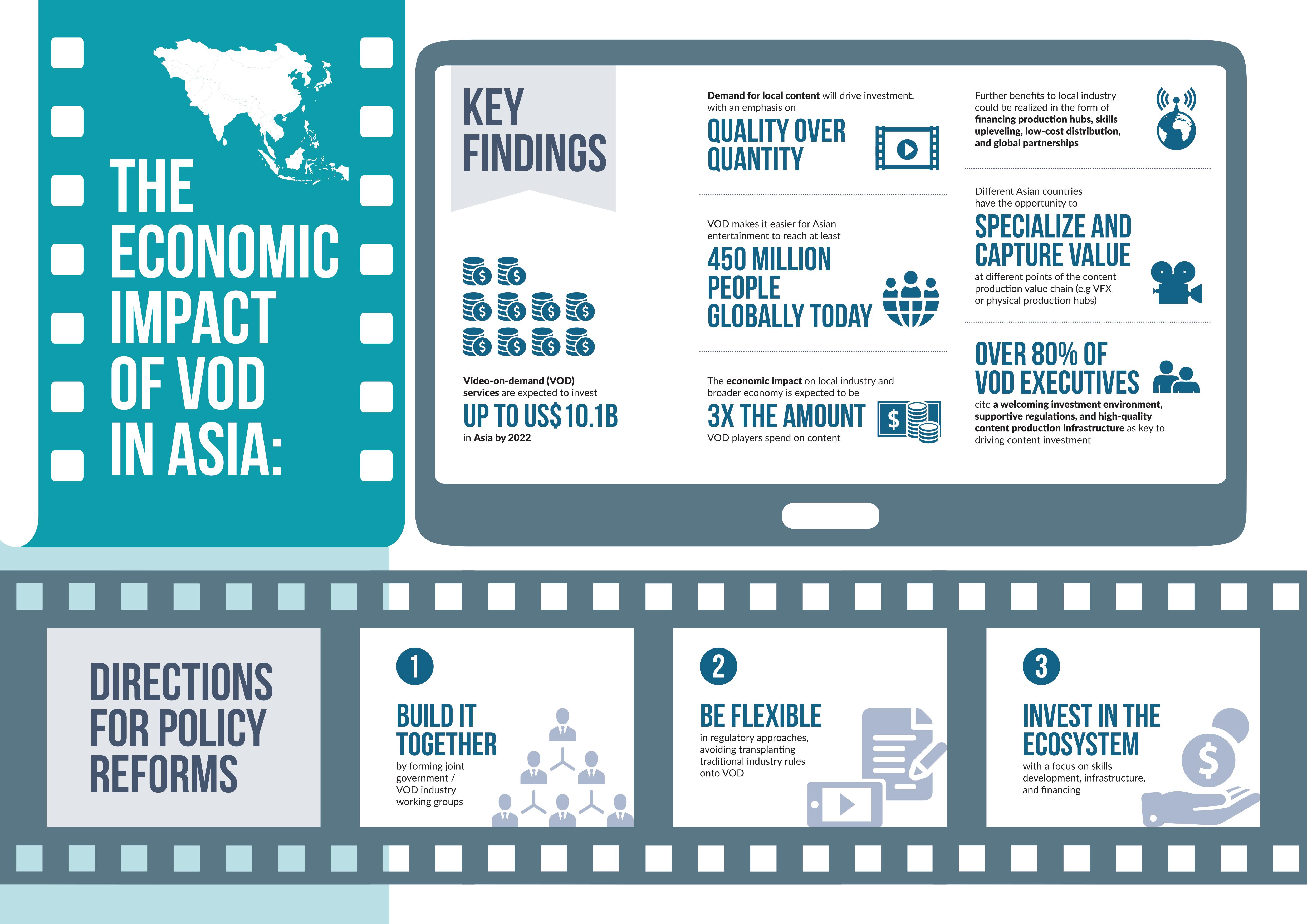

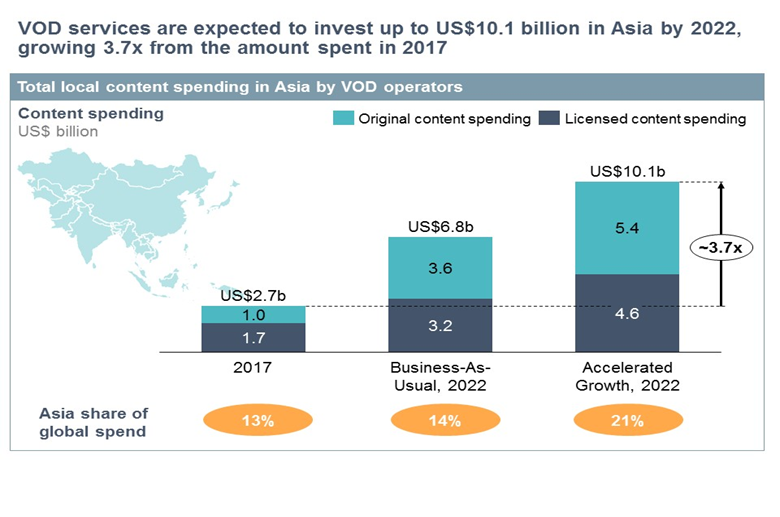

Hong Kong, October 30, 2018 – According to a report released today by strategy and economics consulting firm AlphaBeta, titled “Asia-On-Demand: The Growth of Video-on-demand Investment in Local Entertainment Industries,” video-on-demand (“VOD”) services are expected to invest up to US$10.1 billion in Asia by 2022, growing 3.7x from the amount spent in 2017. The study also found that Asian consumers of VOD services continue to show a strong appetite for local content; prompting industry players to focus on becoming more locally relevant.

Around US$4 billion of this expected investment will be in the form of foreign direct investment by global players. Additionally, the economic impact VOD players will have is expected to be more than 3x the amount spent on investment. This is especially when considering direct spending within the industry on core operations (e.g. equipment, transport, catering, marketing, hospitality, etc.), which in turn drives indirect spending by suppliers (e.g. camera lenses, catering, transport fuel, etc.), and induced spending from workers employed spending their wages in the economy. Up to 736,000 jobs could also be created by this spending in 2022; and there may be spillover benefits to other industries, such as tourism, music, or merchandized products.

At the same time, the study found that the number of paying subscribers in Asia is expected to double in five years, and that viewers in Asian countries have a strong appetite for high quality local content. To meet this growing demand, VOD services will have to become more locally relevant; driving investment to develop more high quality local content to attract and retain subscribers.

Commenting on the report, Konstantin Matthies, AlphaBeta Engagement Manager said, “Given its nascency, the economic impact of VOD services in Asia – particularly in the entertainment industry – has received limited attention to date. This research aims to fill this gap by providing a fact base on the industry’s potential value. The report further identifies best practices, alongside key policy actions to ensure Asian countries can capture this opportunity.”

He added, “As the VOD industry grows in Asia, demand for locally relevant content will drive players to spend a meaningful part of this investment in stories from the region. This is contrary to perceptions that VOD’s easy access to foreign (i.e. Hollywood) content would reduce local demand and dilute cultural values. With strong consumer demand for local content, VOD players will have to increasingly provide high-quality local content to align with these preferences.”

The report outlines seven key findings:

- Video-on-demand (VOD) services are expected to invest up to US$10.1b in Asia by 2022. Globally, VOD operators spent around US$21 billion in 2017 and while Asia accounted for only around US$2.7 billion in content spending in 2017, this could rise by 3.7x by 2022. Around US$4 billion of this spending is in the form of foreign direct investment by global players.

- Demand for local content will drive investment, with an emphasis on quality over quantity. Contrary to common belief, viewers in Asian countries have a strong appetite for local stories and spend equal time watching local and foreign content. With paying subscribers in Asia expected to double over five years, VOD services will need to focus on producing high-quality local content to attract and retain consumers.

- VOD makes it easier for Asian entertainment to reach over 450 million people globally. VOD services are enabling the dissemination of Asian content to wider audiences abroad. For example, the TV series “Sacred Games” from India was watched online by viewers in over 190 countries. This can potentially drive cultural influence and demand for Asian exports, including tourism.

- The economic impact is expected to be 3x the amount VOD players spend on content. Direct spending within the industry on core operations (e.g. equipment, transport, catering, marketing, hospitality, etc.) in turn drives indirect spending by suppliers (e.g. camera lenses, catering, transport fuel, etc.), and induced spending from workers employed spending their wages in the economy. Up to 736,000 jobs could also be created by this spending in 2022. Finally, there are spillover benefits to other industries, such as tourism, music, merchandized products, etc.

- Further benefits to local industry could be realized in the form of financing production hubs, skills upleveling, low-cost distribution, and global partnerships. The benefits that VOD players provide to the local industry is not just through their content spending. They build local skills and introduce new technology. The ability of VOD operators to broker partnerships between local and international players can also be crucial in raising the international appeal of local content, as well as enabling knowledge transfer.

- Different Asian countries have the opportunity to specialize and capture value at different points of the content production value chain e.g. VFX or physical production hubs. Entertainment production has become increasingly global, with many productions having more global footprints, as seen in the recent film “Crazy Rich Asians”. This brings greater opportunity for countries to specialize in specific elements of this value chain. For example, Malaysia and Thailand’s world-class studio facilities and attractive production incentives attract content production from abroad, while Singapore is honing a hub for visual effects and animation.

- Over 80% of VOD executives cite a welcoming investment environment, supportive regulations, and high-quality content production infrastructure as key to driving content investment. Policy reform in these areas can create “virtuous cycles” where local content investment drives high-quality content, which increases demand, which in turn incentivizes further investment. A growing number of Asian markets are already reaping the benefits by focusing on these policy drivers instead of counterproductive policies, for example, local content quotas that instead can result in a “negative spiral” in terms of quality and demand.

The report also outlines several recommendations for Asian policymakers to take full advantage of the VOD industry as a runway for innovation and investment:

- Adopting a collaborative approach with VOD players. Given the benefits provided by VOD players, not just in terms of local content spending, but also in terms of international market access, capability building, and partnership brokering, it is crucial to work closely with these players to build the local industry. There are many good examples of how countries can do this. For example, Taiwan has convened working groups with VOD players and local industry representatives to discuss key issues of concern and how to address them.

- Creating flexible regulation. Some of Asia’s most successful economies have created thriving digital sectors by simplifying regulation for technology companies and startups in the online VOD sphere. Given the rapidly evolving nature of the VOD industry, it is important to not develop regulations that may become quickly obsolete or are not consistent with the characteristics of the industry. One key trap to avoid is to transplant regulatory approaches of the traditional television and film industry to VOD, with local content quotas being a prime example.

- Investing in the local ecosystem. There are a range of opportunities for policymakers to support the local entertainment ecosystem that VOD will contribute to, ranging from training programs, to film festivals, and investment in world-class facilities.

The full report is available for download at www.alphabeta.com/our-research/asia-on-demand