Leading Southeast Asian esports and video game content ecosystem Nexplay and UnionDigital Bank, the digital bank entity of UnionBank, have signed an exclusive partnership that aims to offer more convenient digital financial services for Filipino gamers.

“UnionDigital Bank is driven to further empower the Philippines’ digital economy. Our partnership with Nexplay allows us to offer our financial services to today’s Filipino gamers, enabling them more by giving access to a digital bank account. We are looking forward to this collaboration with Nexplay to propel our higher purpose — Tech-ing Up today’s generation of Filipinos, especially gamers,” said Arvie De Vera, co-founder and CEO of UnionDigital Bank.

In 2019, 43 million Filipino gamers spent a total of USD572 million on games, four-fifths engaged with in-game microtransactions such as buying power-ups and game cosmetics. The following year, revenue generated by the online gaming industry sat at USD 24 million. As cashless payment methods grow in prominence due in part to the pandemic, UnionDigital Bank sees an opportunity to empower Filipino gamers by providing more accessible financial solutions not limited to traditional deposit accounts and debit cards.

“Nexplay opens opportunities for us to engage our country’s digital natives in platforms they are quite familiar with: games. This is particularly important if you consider the rise of play-to-earn gaming and content streaming in the Philippines,” De Vera added.

Nexplay, a Singapore-based company with Filipino leadership, is scaling its business in the Philippines. After reporting a 150% year-on-year revenue growth early this year, Nexplay is gearing up to develop its own Web3 IP in the digital gaming space. The premier Southeast Asian esports gaming brand brings a 250 million-strong built community of video game enthusiasts, young professional esports athletes, over 400 high-profile content creators, and a solid portfolio of more than 200 big brands and clients.

“For Nexplay, our mission has always been helping gamers succeed. Working with UnionDigital Bank will help crystallize this combined vision of making financial services more accessible to our massive gaming community, our fans, our teams and our talents to enrich their digital experience. Together, we are committed to encourage greater financial inclusion within the rapidly growing gaming community in the Philippines, especially the next-generation gamers.” shared Gabriel Paulo Benito, co-founder and CEO of Nexplay.

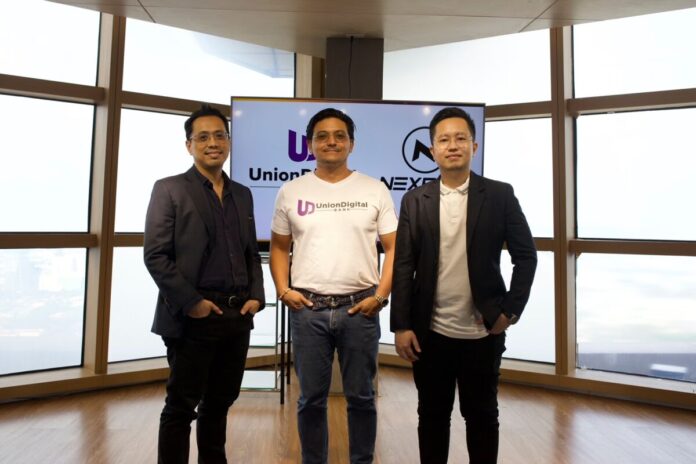

co-founder of NEXPLAY; Arvie De Vera, CEO and co-founder of UnionDigital Bank; Gabriel Benito, CEO and co-founder of NEXPLAY; Mike Singh, chief revenue and lending officer of UnionDigital Bank; Munmun Nath, chief marketing officer of UnionDigital Bank; Boom Eufemio, chief community officer of UnionDigital Bank.